Table of Contents

While retail investors chase memecoins and hype-driven altcoins, the world’s biggest financial players are making a quiet but seismic shift. They’re not just investing in Bitcoin—they’re adopting a radically different strategy that’s outperforming Bitcoin itself. What exactly are they doing? And why is this the biggest opportunity for wealth creation in crypto today?

Welcome to the new era of institutional Bitcoin dominance—and the rise of Bitcoin treasury strategy companies.

Altcoin Graveyard: The Harsh Reality for Retail Investors

Altcoins had their moment. From 2017 to 2019, investing in cryptocurrencies outside of Bitcoin was a winning game. Coins like Ethereum and XRP soared, driven by retail speculation and meme-fueled FOMO. But those days are over.

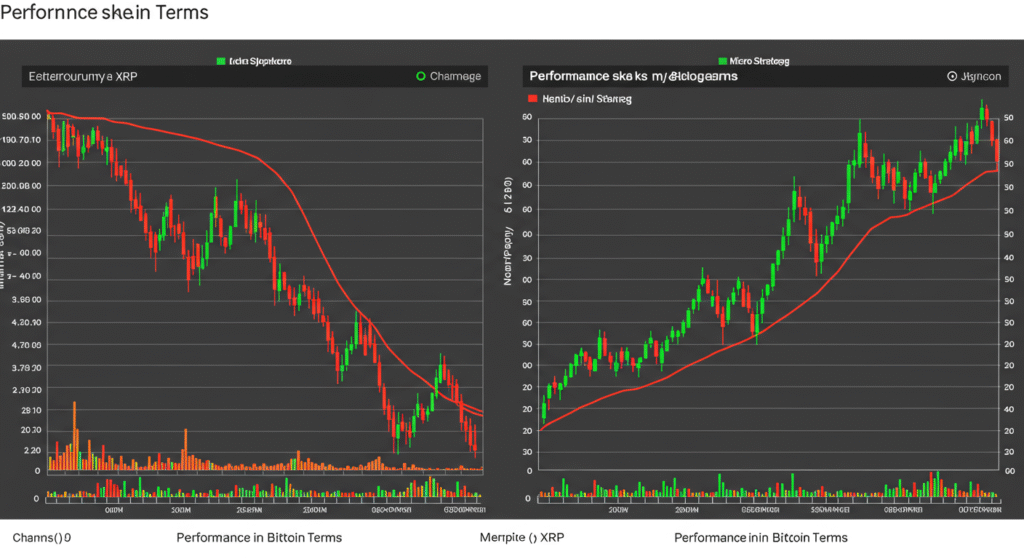

Let’s talk numbers.

- Ethereum (ETH): Down 49% from its all-time high when priced in U.S. dollars. Even worse, it’s down 84% when measured against Bitcoin.

- XRP: Down 34% from its all-time high in USD. But in Bitcoin terms? A staggering 90% drop.

These aren’t just temporary dips. They’re part of a long-term trend—what some are now calling the “Altcoin Graveyard.”

Why is this happening? Because we’ve entered a new phase in the tech-investment cycle—one where institutional players call the shots.

The 50-Year Cycle: From Retail Hype to Institutional Frenzy

Every 50 years, technology goes through a four-phase cycle:

- Eruption Phase – Retail-driven excitement and speculation.

- Frenzy Phase – Institutions and sovereign funds enter with big money.

- Synergy Phase – Integration of the tech into society and business.

- Deployment Phase – Full-scale adoption and stable growth.

In crypto, we’ve clearly moved from Phase 1 to Phase 2.

Phase 1 (2009–2020) was about retail. Enthusiasts, tech-savvy investors, and early adopters bought into altcoins and rode massive waves of growth. Small investments in low-cap coins made some people millionaires.

Phase 2 (2021 onward) is the institutional frenzy phase. Pension funds, sovereign wealth funds, and Wall Street firms have entered the game—and they’re not interested in speculative tokens. They need real assets, real infrastructure, and regulatory compliance.

Bitcoin Dominance Is Back—and Bigger Than Ever

Bitcoin is no longer just a cryptocurrency; it’s become an institutional-grade asset. In 2025 alone, over $85 billion has flowed into Bitcoin, and BlackRock has funneled $4 billion in just two weeks. But the real story? It’s not just Bitcoin they’re buying.

Enter the new asset class: Bitcoin Treasury Strategy Companies.

What Are Bitcoin Treasury Strategy Companies?

These are publicly traded companies that don’t just hold Bitcoin—they build their business model around it.

Example 1: MicroStrategy

MicroStrategy, led by Michael Saylor, pioneered the Bitcoin treasury model. Initially a software company, it rebranded its identity around Bitcoin and now holds over 580,000 BTC (as of May 2025). But here’s the kicker:

- MicroStrategy’s performance in Bitcoin terms: +278%.

- This means it’s outperforming Bitcoin, which itself is up over 1,500% in the last five years.

How? By leveraging debt and equity markets to buy Bitcoin at scale, amplifying returns.

Example 2: Metaplanet

This Japanese company took MicroStrategy’s model and ran with it. Result?

- Performance vs. Bitcoin: +677%.

- Yes, you read that right. Not just beating the S&P or Ethereum—beating Bitcoin itself.

These companies operate under strict regulations, are listed on NASDAQ or similar exchanges, and have audited financials, real revenues, and SEC compliance—everything an institutional investor needs.

Why Institutions Prefer These Companies

Big investors can’t just throw billions into Shiba Inu or some random DeFi project. They need:

- Liquidity: Assets that can absorb billions without slippage.

- Transparency: Audited financials and clear regulatory status.

- Compliance: SEC filings, shareholder disclosures, and a real board of directors.

- Scale: Public companies that can grow with institutional capital.

This makes Bitcoin treasury companies the perfect vehicle. They’re like Bitcoin derivatives—giving exposure to Bitcoin, but with greater upside potential due to their strategic leverage.

Real Returns: How BTC Companies Are Crushing the Market

Compare year-to-date 2025 performance:

- NASDAQ: Flat.

- S&P 500: Flat.

- Ethereum: Down 32%.

- Bitcoin: Up 50-60% (approx.).

- MicroStrategy: Up 278% (in BTC terms).

- Metaplanet: Up 677% (in BTC terms).

- Matador (Canada): Up 337% (in BTC terms).

We’re seeing 1000%+ outperformance over both traditional finance and crypto altcoins.

This is the new bull run—but it’s happening in a completely different asset class.

This Is the New Altcoin Season—But Smarter

Altcoin season used to be about Ethereum, XRP, Cardano, and dozens of others pumping on speculation. Today, altcoin season looks like:

- Bitcoin-native public companies.

- Listed on global exchanges.

- Supported by trillions in institutional capital.

- Transparent, compliant, and built to scale.

They’ve become the new altcoins—but with real fundamentals.

Where Is All This Headed?

So how much more money is flowing in?

Here are some projections:

- MicroStrategy: Raised over $10 billion to deploy into Bitcoin.

- Metaplanet: $5 billion allocated.

- Meta, Naka, and others: Hundreds of millions more.

- ETFs: Projected inflow of $55B–$120B in 2025 alone.

This is the biggest capital injection Bitcoin has ever seen—and it’s not flowing into DeFi farms or meme tokens. It’s flowing into institutional-grade Bitcoin plays.

What Should Smart Investors Do Now?

If you’re still buying random altcoins hoping for 10x pumps, you’re likely stuck in a Phase 1 mindset. The winners in this new era are thinking bigger.

Here’s your new checklist:

✅ Follow the money: Track institutional inflows, not YouTube hype.

✅ Invest in real companies: Look for Bitcoin-focused businesses with strategic treasury models.

✅ Learn the metrics: Understand concepts like Bitcoin Yield, BPS, and Torque—new tools for evaluating Bitcoin-native firms.

✅ Pivot your strategy: Phase 1 was about hype; Phase 2 is about fundamentals and capital flows.

Final Thoughts: The New Gold Rush Is Here

We’re witnessing a massive rotation—out of speculative altcoins and into real, Bitcoin-native companies. The institutions have arrived, and they’re playing by different rules.

But here’s the good news: You can still get in early. Most retail investors don’t even know this asset class exists. But now you do.

You can ride this wave—just like early investors rode Apple and Microsoft through their second growth phase. But only if you recognize the shift and act accordingly.

The future of crypto isn’t just about tokens—it’s about real companies, real strategies, and massive institutional capital. This is where the next generational wealth will be created.