Table of Contents

The cryptocurrency market is ablaze with excitement once more, and it is at the center of the discussion. The high-performance blockchain, which is stable at the psychological $150 price mark, has reached a pivotal moment. This crucial level symbolizes a conflict between bullish optimism and more general market worries; it is more than just a number on a chart. Many are observing to see if this is the time that lays the groundwork for a big rally in the second half of 2025, given the combination of encouraging technical patterns, increased institutional interest, and a strong macroeconomic outlook.

Introduction: Solana at a Crucial Price Point

Certain price points take on significance in the ever-changing world of cryptocurrencies, serving as either psychological obstacles or launching pads. The $150 threshold has become such a turning moment. Many people view its capacity to sustain this level during a period of fluctuation as evidence of underlying strength and resilience. This isn’t just about making quick money; it’s also about creating a new foundation that might lead to a long-term rising trend. Both traders and long-term investors are paying close attention to performance at this critical juncture as the market processes multiple global signals. The story of Solana now revolves around its proven capacity to hold its own as well as its promise.

Recent Price Performance: Steady or Shaky?

A phase of consolidation is revealed by examining the recent price action of Solana. There are two possible interpretations for the recent stability around $150 after months of notable volatility. One could argue that the absence of a significant decline in spite of general market anxiety is a sign that the market is stabilizing and that selling pressure is being absorbed. However, the inability to make a clear move above this level can be seen as an indication that buyers are not entirely convinced.

A closer examination of the daily charts, however, points to an accumulation phase. There haven’t been any notable selling spikes, which frequently occur before a large price decline, and the trading volume has been steady.

The Bullish Patterns Keeping Traders Optimistic

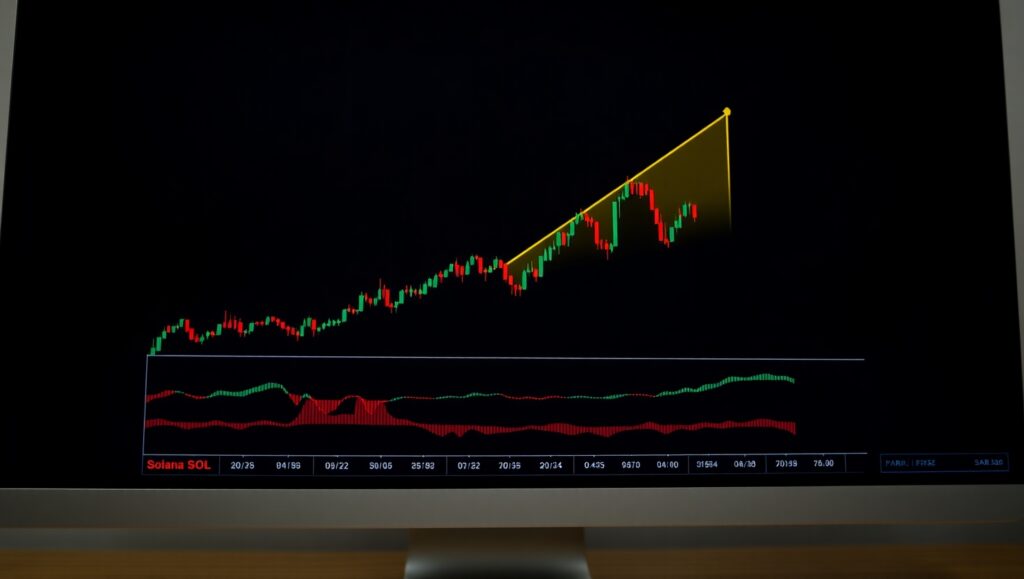

On Solana’s price charts, technical analysts are highlighting a number of bullish formations that are boosting confidence. A possible ascending triangle is one of the most discussed patterns. It is a traditional bullish indicator that indicates the likelihood of an upside breakout is growing. A rising trendline of higher lows and a horizontal resistance level—in this example, the upper $150s—form this pattern.

Additionally, there are indications of bullish divergence, where the price makes a new low and the Relative Strength Index (RSI) creates a higher low. This frequently comes before an upward price reversal.

How US-China Talks Are Impacting the Crypto Market

There is more to the bitcoin business than meets the eye. All financial markets, including cryptocurrency, are susceptible to the effects of geopolitical events, particularly those involving economic superpowers like the US and China. An excellent illustration of this interdependence is the current trade negotiations between the two countries.

A “risk-on” attitude among investors is typically fostered by positive developments and a de-escalation of trade hostilities. Investors are more inclined to place money into riskier, higher-growth assets like cryptocurrencies when the future for the world economy seems more steady. Because market players are more optimistic about the future, this might result in higher capital inflows for a well-known cryptocurrency like Solana. On the other hand, if these negotiations fail, there may be a flight to safety, which might slow down Solana’s progress. Therefore, the upbeat tone of these conversations is creating a positive tailwind for the whole cryptocurrency market, and consequently for Solana.

Solana vs Other Altcoins: Who’s Leading the Pack?

Solana maintains its position as a leader in the highly competitive Layer 1 blockchain market. Ethereum is still in control, but Solana’s core benefits—high throughput and cheap transaction costs—make it a desirable substitute for developers and users, especially in fast-growing industries like non-fungible tokens (NFTs) and decentralized finance (DeFi).

Comparing performance measures, Solana has continuously shown that it can manage a large number of transactions, which is essential for widespread adoption. With an increasing number of projects expanding on its network, its ecosystem has also experienced rapid expansion. Even while other altcoins are also advancing, Solana is leading the competition to become the preferred blockchain for the upcoming generation of decentralized applications because of its special blend of speed, scalability, and a quickly growing developer and user base. One of the main causes of the optimistic outlook for Solana’s future is its leadership role.

Whale Activity and Institutional Interest in Solana

Solana’s long-term potential is being strongly validated by the actions of large-scale investors, or “whales,” and the increasing interest from institutional players. Large wallets have accumulated a substantial amount, according to on-chain statistics, indicating that sophisticated investors are adopting a long-term positive position. Many people consider this whale action to be a leading indicator of future price changes.

Additionally, the story of Solana’s institutional adoption is becoming more popular. There are increasingly more reports of corporations and investment firms investigating or actively investing in the Solana ecosystem. Another much debated topic is the possibility of a spot Solana ETF in the future, which would welcome a fresh influx of institutional capital. This increasing interest from the conventional banking sector is a strong testament to Solana’s technology and its potential to be a key component of the digital economy of the future.

What $150 Means for Solana’s Long-Term Outlook

For long-term prognosis, a successful establishment of $150 as a new support level would be extremely optimistic. A classic technical analysis confirmation of a new, higher trading range is when a former resistance level flips to support. It would indicate that Solana’s fair value is now well above its prior trading zones, as determined by the market as a whole.

As a result, would have a strong platform to start its next significant price discovery phase. Retail and institutional investors would feel more confident if this level were maintained, which would promote more investment and growth in the ecosystem. Its long-term prospects are significantly improved by a strong foundation at $150, which essentially turns it from a speculative asset to a more established participant with a track record of price stability and development.

Analyst Predictions: Can Solana Rally in H2 2025?

Many analysts are cautiously optimistic about Solana’s chances of a big rally in the second half of 2025. Although price forecasts differ, almost all anticipate an upward breakout if the current state of the market holds. In the upcoming months, some experts are aiming for price goals between $200 and $250, with more optimistic long-term projections pointing to even higher levels.

These forecasts are frequently based on a number of variables, such as the bullish technical patterns’ successful resolution, the ecosystem’s ongoing expansion, and a positive macroeconomic climate. The combination of favorable indications has caused many market watchers to conclude that well-positioned for a strong performance in the second half of the year, even though past performance is not a reliable predictor of future outcomes.

Risks to Watch: What Could Derail Solana’s Momentum?

It is important to recognize the possible threats that could halt Solana’s pace, even in spite of the bullish sentiment. Even while they are getting less frequent, the network’s history of sporadic disruptions still worries some investors. Any prolonged outage could undermine trust and have a detrimental effect on the pricing.

Another thing to think about is competition from other high-performance blockchains. To keep its competitive edge as the market gets more saturated, will need to keep coming up with new ideas and luring developers. Lastly, it is impossible to overlook the constant threat of regulatory obstacles. Major countries imposing strict new rules on cryptocurrency could have a negative impact and the entire industry. Any well-rounded investing theory must recognize and keep an eye on these dangers.

Final Thoughts: Bullish Signs vs Real-World Factors

All things considered, Solana is in a strong position. There are indications of hope in the macroeconomic environment, accumulation is suggested by whale behavior, and positive signals are blazing on the technical charts. The $150 level’s stability is evidence of the Solana network’s underlying strength and growing confidence in its long-term prospects.

It is a market of headlines and charts, nevertheless. Even while the optimistic trends are positive, future course will be greatly influenced by external variables, including as the conclusion of international trade negotiations and the constantly changing regulatory environment. The odds appear to be in favor of the bulls for the time being, but as with any investment in the ever-changing cryptocurrency space, caution and knowledge are crucial. Solana’s voyage is far from done, and whether or whether these optimistic indications turn into a strong and long-lasting rally will be determined in the upcoming months.

FAQs

1. Why is the $150 price for Solana a big deal?

Holding $150 is a key bullish sign. It shows turning a past price ceiling into a new support floor, which could launch its next rally.

2. What’s causing the optimism around Solana?

Traders are seeing bullish technical patterns like an “ascending triangle,” and major investors (“whales”) are reportedly buying and holding, signaling strong confidence.

3. What is Solana’s main advantage over other cryptos?

Its primary edge is performance. Its offers significantly faster transaction speeds and lower fees than many rivals, making it ideal for high-volume applications.