Introduction & Understanding Student Credit Cards

Building a solid financial foundation is crucial, and for students, a credit card can be a powerful tool in that journey. Many students find themselves wondering how to establish a good credit history early on, and a student credit card provides a perfect avenue to do just that. Unlike regular credit cards, student versions are designed with the unique financial circumstances of students in mind, often featuring lower credit limits and more lenient approval requirements. Essentially, a student credit card is a type of credit card specifically marketed to college or university students. It allows you to make purchases on credit, which you then repay according to the card’s terms. This establishes a credit history, which is vital for future financial endeavors like renting an apartment, securing a loan, or even getting a good insurance rate. Understanding the basics of how credit cards work is the first step towards responsible financial management. It’s not just about spending; it’s about building a future.

- For a deeper dive into credit scores, you can explore resources from the Consumer Financial Protection Bureau: https://www.consumerfinance.gov/

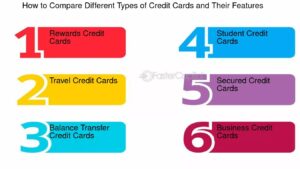

Key Features to Look for in a Student Credit Card

Choosing the right student credit card involves considering several key features. First, look for credit cards with low or no annual fees. As a student, every dollar counts, and avoiding unnecessary fees is essential. Secondly, pay attention to the interest rates, or APR. While you should aim to pay your balance in full each month, understanding the APR is crucial in case you need to carry a balance. Many student credit cards offer reasonable APRs, but it’s important to compare. Rewards and cashback programs are another attractive feature. Some credit cards offer cashback on everyday purchases like groceries or gas, allowing you to earn while you spend. A manageable credit limit is also vital. Starting with a lower limit helps you avoid overspending and build responsible spending habits. Ensure the credit card company reports to major credit bureaus (Experian, Equifax, and TransUnion). This is how your credit history is built. Finally, look for credit card issuers that provide educational resources and tools to help you learn about financial responsibility.

- To understand APR better, check out this explanation from Investopedia: https://www.investopedia.com/terms/a/apr.asp

Top Student Credit Card Options (with Specific Examples)

When selecting a student credit card, it’s best to compare specific offers. Here are a few examples:

- Discover it® Student Cash Back: This credit card is popular among students for its cashback rewards, which often include rotating categories that align with student spending. It also typically has no annual fee and good customer service.

- Journey® Student Rewards from Capital One®: This credit card is designed for students with limited credit history. It offers cashback rewards and encourages responsible credit use.

- Bank of America® Customized Cash Rewards credit card for students: This option allows students to choose their own cashback category, providing flexibility based on their spending habits.

When comparing these credit cards, consider factors like rewards programs, APR, and any additional benefits offered. Choosing the right credit card depends on your individual needs and spending habits.

Responsible Credit Card Use for Students

Using a student credit card responsibly is paramount. Create a budget to manage your spending effectively. Track your expenses and ensure you’re not overspending. Pay your bill on time, every time. Late payments can negatively impact your credit score and result in late fees. Understand your credit utilization ratio, which is the amount of credit you’re using compared to your total credit limit. Aim to keep it below 30%. Avoid overspending and accumulating credit card debt. Credit card debt can be difficult to manage, especially for students. Monitor your credit score regularly to track your progress and identify any potential issues. Building good credit habits while in college will set you up for financial success in the future.

- For budgeting tips, explore resources from the National Foundation for Credit Counseling: https://www.nfcc.org/

Application Process and Approval Tips

The application process for a student credit card is typically straightforward. You’ll need to provide personal information, including your name, address, and social security number. Many issuers also require proof of student enrollment. Eligibility requirements vary, but generally, you’ll need to be at least 18 years old and have a valid social security number. Gathering the necessary documentation, such as proof of enrollment and identification, will help streamline the process. Applying online is often the most convenient option, as you can complete the application from anywhere. If your application is denied, don’t be discouraged. Contact the credit card issuer to understand the reasons for the denial and take steps to address any issues. Understanding the difference between secured and unsecured student credit cards is also important. Secured credit cards require a security deposit, while unsecured credit cards do not. To improve your approval odds, make sure your information is accurate and up to date, and if you have any existing accounts, that they are in good standing.

Long-Term Benefits and Next Steps

Building a strong credit history with a student credit card offers numerous long-term benefits. A good credit score opens doors to future opportunities, such as securing loans, renting apartments, and getting better insurance rates. After graduation, you can transition to a regular credit card with better rewards and benefits. The impact of good credit on your financial future cannot be overstated. Maintaining good credit habits beyond college is essential for long-term financial success. Continue to pay your bills on time, manage your credit utilization, and monitor your credit score.

- For more information on the long-term benefits of good credit, visit MyFICO: https://www.myfico.com/

Frequently Asked Questions About Student Credit Cards

- Q: Can I get a student credit card with no credit history?

- A: Yes, many student credit cards are designed for students with limited or no credit history.

- Q: What is the difference between a secured and unsecured student credit card?

- A: A secured credit card requires a security deposit, while an unsecured credit card does not.

- Q: How often should I check my credit score?

- A: You should check your credit score at least once a year, or more frequently if you’re actively building credit.

- Q: What happens if I miss a credit card payment?

- A: Missing a payment can result in late fees and negatively impact your credit score.

Conclusion

A student credit card is a valuable tool for building credit and establishing a solid financial foundation. By choosing the right credit card and using it responsibly, students can set themselves up for financial success. Remember to compare credit card offers, understand the terms and conditions, and prioritize responsible credit use. Empower yourself to take control of your financial future by making informed decisions and building good credit habits.