Why Blogging is Still a Lucrative Side Hustle in 2024

Blogging remains one of the most profitable side hustles in 2024, offering a low-cost entry point and the potential to generate passive income. With billions of internet users worldwide, people constantly search for information on credits, loans, and other financial topics. If you can provide valuable insights, you can attract a dedicated audience and monetize your content effectively.

Unlike social media, where algorithms change frequently, a blog gives you full control over your content. With search engine optimization (SEO), your posts can rank on Google and bring in organic traffic for years. Plus, blogging allows you to earn money through multiple channels, including affiliate marketing, ad revenue, and sponsored content.

Step 1: Choose a Profitable Blog Niche

Picking the right niche is the foundation of a successful blog. Since we’re focusing on credits and loans, here are a few sub-niches you can consider:

-

Personal Finance – Teach people how to manage their credit scores and secure loans.

-

Credit Cards & Rewards – Review credit cards and recommend the best ones for specific needs.

-

Debt Management – Help readers get out of debt and improve their financial health.

-

Business Loans & Financing – Guide entrepreneurs on securing business loans and funding.

When selecting your niche, ensure it has high search volume, affiliate opportunities, and a passionate audience willing to spend money.

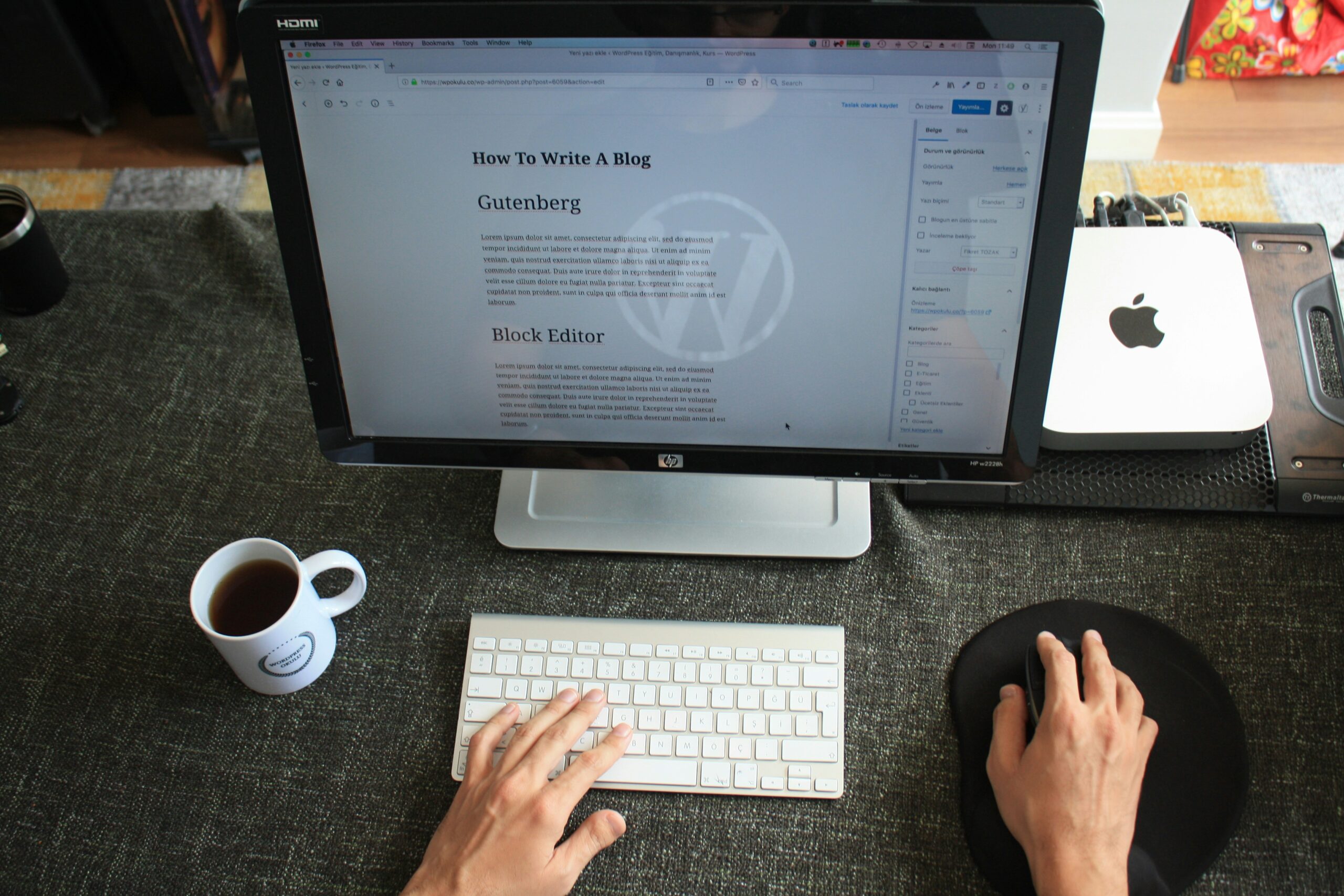

Step 2: Set Up Your Blog (Fast & Cheap)

Starting a blog is easier than ever. Follow these quick steps:

-

Get a Domain Name & Hosting – Choose a domain related to credits or loans (e.g., SmartCreditTips.com). Use a reliable hosting provider like Bluehost or SiteGround.

-

Install WordPress – Most hosting providers offer a one-click WordPress installation.

-

Pick a Theme – Astra (free) or GeneratePress (premium) are great for financial blogs.

-

Install Essential Plugins – Yoast SEO, WP Rocket, and MonsterInsights help optimize your site.

Step 3: Design a Blog That Converts

Your blog design impacts user experience and conversions. Here’s what to focus on:

-

Clean & Professional Look – Use a simple, mobile-friendly layout.

-

Fast Loading Speed – Optimize images and enable caching.

-

Clear Navigation – Make it easy for visitors to find key sections like “Best Credit Cards” or “Loan Reviews.”

-

Strong Call-to-Actions (CTAs) – Encourage users to sign up for newsletters or apply for recommended financial products.

Step 4: Create Content That Ranks on Google

To get free traffic from Google, your blog posts must be optimized for SEO. Follow these steps:

-

Keyword Research – Use tools like Ahrefs or Ubersuggest to find keywords related to credits and loans.

-

Write In-Depth Articles – Aim for at least 1,500 words per post to cover topics thoroughly.

-

Use External Links – Link to authoritative sources like NerdWallet or Bankrate.

-

Optimize for Readability – Use short paragraphs, bullet points, and images.

Step 5: Drive Traffic Like a Pro

Traffic is the lifeblood of a successful blog. Here’s how to attract visitors:

SEO Traffic – Optimize posts for Google search.

Pinterest Marketing – Create eye-catching pins and share them.

Facebook Groups & Forums – Engage in finance-related discussions.

Email Marketing – Collect emails and send valuable newsletters.

Guest Posting – Write for other finance blogs to gain

Step 6: Monetize Your Blog (5 Proven Methods)

Here are the best ways to earn money from your blog:

Affiliate Marketing – Promote credit cards and loan providers for commissions.

Google AdSense & Display Ads – Earn money from ad impressions and clicks.

Sponsored Posts – Partner with financial brands for paid content.

Online Courses & Ebooks – Sell financial guides or courses.

Consulting Services – Offer financial coaching or credit repair services.

How to Scale to $1000/Month (and Beyond)

To reach and exceed $1000 per month:

-

Publish Consistently – Aim for 2-3 posts per week.

-

Update Old Content – Refresh outdated posts for better rankings.

-

Diversify Income Streams – Don’t rely on just one revenue source.

-

Network with Other Bloggers – Collaborate and share audiences.

Real-Life Case Study: From 0 to $1k/Month in 90 Days

Meet John, a finance blogger who started from scratch. His journey:

-

Month 1: Wrote 15 blog posts and focused on SEO.

-

Month 2: Used Pinterest and guest blogging for traffic.

-

Month 3: Applied for affiliate programs and earned his first $1000

Tools to Accelerate Your Success

-

Grammarly – Ensures error-free writing.

-

Canva – Helps create professional-looking images.

-

Google Analytics – Tracks traffic and performance.

-

SEMrush – Advanced SEO and keyword research.

Common Mistakes New Bloggers Make

Avoid these common pitfalls:

-

Choosing the Wrong Niche – If there’s no demand, monetization is difficult.

-

Ignoring SEO – Without proper optimization, your blog won’t rank.

-

Giving Up Too Soon – Blogging takes time; stay consistent.

-

Not Building an Email List – Email marketing boosts engagement and revenue.

Final Tips to Stay Motivated

Set small milestones to stay encouraged.

Follow successful bloggers for inspiration.

Remember, blogging is a long-term game.

Conclusion: Your First $1000 is Closer Than You Think

Starting a blog in the credits and loans niche can be a profitable venture. Follow these steps, stay consistent, and soon you’ll be making money online.

FAQs

1. How long does it take to make money blogging? It varies, but many bloggers start earning within 3-6 months with the right strategies.

2. Do I need technical skills to start a blog? No, platforms like WordPress make it easy for beginners.

3. Can I start a blog with no money? You need a small investment for hosting and a domain, but it’s minimal.

Ready to start your blog? Take action today!