Introduction: Palantir’s Unstoppable Momentum

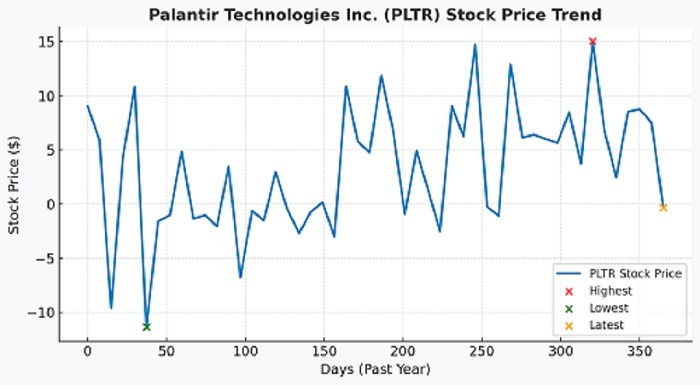

Palantir Technologies Inc. (NYSE: PLTR) has been on an extraordinary run, extending its rally for the third consecutive day on Thursday. The stock soared over 7% by mid-morning, continuing its impressive uptrend after the company’s strong Q4 earnings report earlier this week. In just three days, Palantir’s stock has surged by more than 20%, significantly boosting its market capitalization and adding approximately $40 billion in paper wealth.

Investors and analysts alike are starting to take note of this impressive movement, prompting revisions to price targets and sparking discussions about the company’s future trajectory. Despite concerns regarding valuation, the stock continues to gain momentum. In this article, we take a deep dive into what’s driving Palantir’s growth, how analysts are reacting, and what investors should expect moving forward.

The Catalyst Behind Palantir’s Rally

Q4 Earnings Blowout

One of the primary reasons behind Palantir’s stock surge is its remarkable Q4 earnings performance. The company reported revenue growth exceeding expectations, driven by strong demand for its artificial intelligence (AI) and big data analytics solutions.

Key Highlights from the Q4 Report:

- Revenue: Palantir posted revenue of $608 million, surpassing Wall Street estimates of $600 million.

- Profitability: The company achieved its sixth consecutive quarter of profitability, reporting a net income of $121 million.

- Customer Growth: Palantir’s commercial customer base grew by 35% year-over-year, showcasing increased adoption of its AI-powered solutions.

These robust earnings have fueled investor optimism, reinforcing Palantir’s position as a leader in the AI-driven analytics industry.

Analysts’ Changing Stance on Palantir

Historically, Wall Street has been skeptical of Palantir due to its high valuation and unconventional business model. However, following its strong earnings, analysts have been forced to revise their outlook on the stock. Several firms have increased their price targets, acknowledging the company’s growth potential and solid financial performance.

Updated Analyst Price Targets:

- The consensus target price for Palantir was around $45 at the end of December but has now risen to nearly $87.

- Despite the upward revision, this target remains about 15% below the stock’s current trading level, signaling that some analysts remain cautious about the company’s long-term valuation.

- Major financial institutions such as JPMorgan and Morgan Stanley have issued more favorable ratings, citing the company’s impressive execution and AI-driven revenue potential.

One analyst noted, “Palantir’s AI-driven software solutions continue to see increasing adoption across industries. While valuation remains a concern, the company’s consistent profitability and growing commercial segment make it an attractive long-term play.”

Investor Sentiment and Market Reaction

Investor sentiment towards Palantir has shifted dramatically over the past year. Initially viewed as a government-dependent firm, Palantir has successfully expanded its commercial footprint, securing contracts with major corporations in healthcare, finance, and logistics.

Key Factors Driving Investor Optimism:

- AI Boom: The rising adoption of artificial intelligence has positioned Palantir as a key player in the industry.

- Strong Institutional Support: Hedge funds and institutional investors have increased their holdings in Palantir, further driving the stock higher.

- Retail Investor Interest: Palantir has garnered significant attention on social media platforms such as Reddit and Twitter, with many retail investors seeing it as a long-term AI growth stock.

With both institutional and retail investors backing the stock, Palantir’s rally seems poised to continue in the near term.

Is Palantir’s Valuation Justified?

Despite the bullish momentum, Palantir’s valuation remains a topic of debate. The company currently trades at a high price-to-earnings (P/E) ratio compared to industry peers, raising questions about sustainability.

Bullish Case:

- Consistent Profitability: Palantir has now delivered six consecutive profitable quarters, a rarity in the AI space.

- Strong Revenue Growth: The company is expanding both its government and commercial business segments, reducing dependency on a single revenue stream.

- AI Adoption: As AI technology continues to integrate into industries worldwide, Palantir’s software could become a necessity rather than a luxury.

Bearish Case:

- Lofty Valuation: Even after the recent upgrades, the stock remains expensive relative to earnings.

- Competition: Major tech players such as Microsoft, Google, and IBM are aggressively expanding their AI offerings, posing a challenge to Palantir’s dominance.

- Market Sentiment Dependence: A significant portion of Palantir’s gains has been driven by momentum and investor enthusiasm. If sentiment shifts, the stock could see a sharp correction.

What’s Next for Palantir?

Given its strong earnings, growing customer base, and AI-driven future, Palantir seems well-positioned for further growth. However, investors should remain mindful of potential risks and volatility.

Short-Term Outlook:

- Continued momentum is likely to drive the stock higher in the coming weeks.

- More analyst upgrades could provide additional fuel for the rally.

- Market corrections or broader economic concerns could lead to pullbacks, presenting buying opportunities.

Long-Term Outlook:

- AI integration across industries will likely boost demand for Palantir’s services.

- Expanding commercial contracts could reduce reliance on government deals, making the company’s revenue more stable.

- Sustainable profitability and strategic partnerships will be key indicators of future success.

Final Thoughts

Palantir Technologies Inc. has emerged as one of the hottest AI stocks in recent times, with its recent rally reflecting strong earnings, increased adoption, and shifting Wall Street sentiment. While valuation concerns persist, the company’s profitability, customer growth, and AI leadership make it a compelling long-term play.

For investors, Palantir presents an intriguing opportunity—but one that requires careful consideration of risks and rewards. As AI continues to shape the future, Palantir’s role in the evolving landscape will be critical, making it a stock to watch closely.