Introduction: Why Budgeting Matters

Money is one of the most crucial aspects of life, yet many people struggle to manage it effectively. Without a clear budgeting plan, it’s easy to overspend, live paycheck to paycheck, or neglect savings. This is where the 50/30/20 rule comes in—a simple and effective budgeting method that helps you allocate your income wisely. Whether you’re trying to get out of debt, save for the future, or just gain better control of your finances, understanding this rule can be a game-changer.

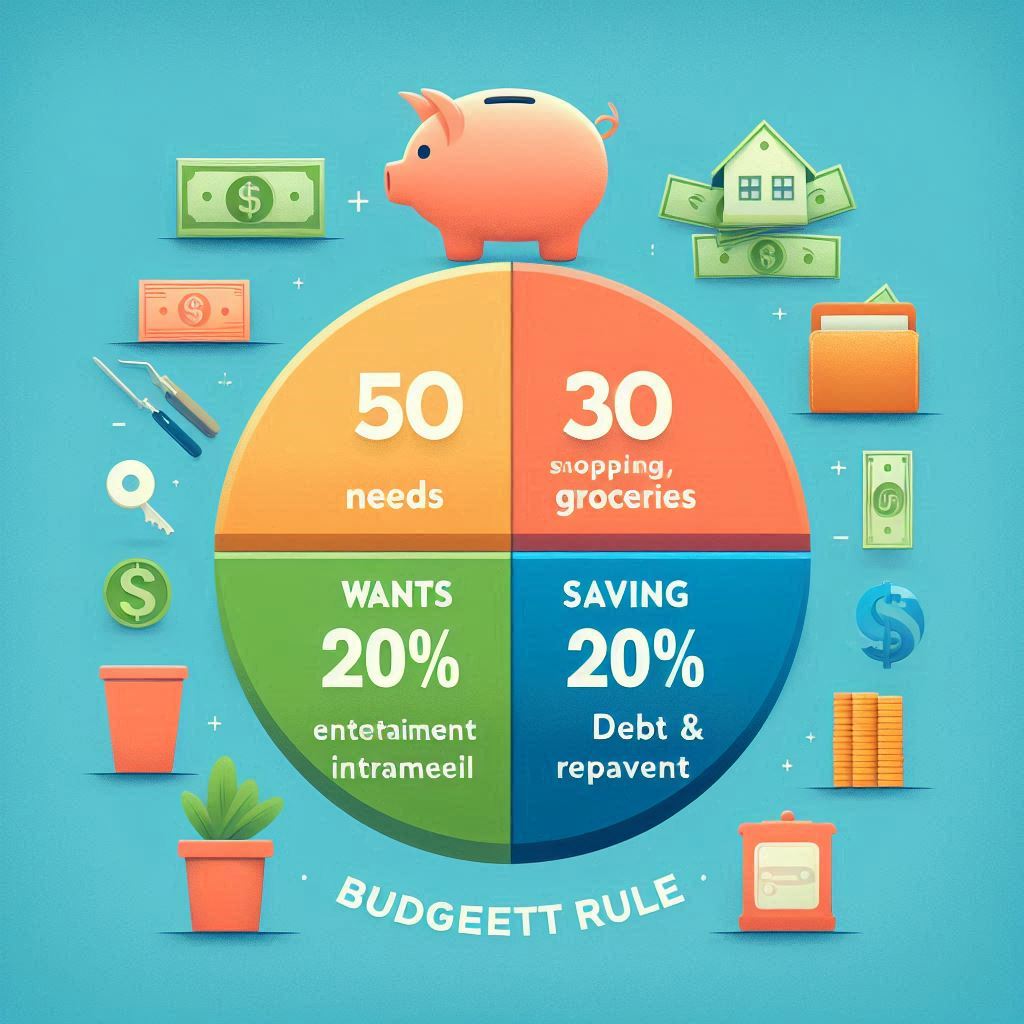

What is the 50/30/20 Rule?

The 50/30/20 rule is a straightforward budgeting guideline that helps you divide your income into three main categories:

- 50% for Needs – Essentials like housing, utilities, groceries, and insurance.

- 30% for Wants – Entertainment, dining out, shopping, and leisure activities.

- 20% for Savings and Debt Repayment – Emergency funds, retirement savings, and paying off loans.

This rule was popularized by Elizabeth Warren and her daughter Amelia Warren Tyagi in their book All Your Worth: The Ultimate Lifetime Money Plan. It simplifies money management by ensuring that you cover essential expenses while still enjoying life and saving for the future.

Breaking Down the 50/30/20 Rule

50% for Needs

Half of your income should go toward needs—expenses that are necessary for daily living. This includes:

- Rent or mortgage payments

- Utility bills (electricity, water, gas, internet)

- Groceries

- Health insurance

- Transportation (car payments, gas, public transit)

- Minimum debt payments

If your necessary expenses exceed 50% of your income, you might need to adjust your lifestyle by downsizing, finding ways to cut utility costs, or searching for more affordable transportation options.

30% for Wants

Wants are the non-essential expenses that bring joy and entertainment to your life. Examples include:

- Eating out at restaurants

- Streaming services (Netflix, Spotify, etc.)

- Gym memberships

- Shopping for clothes, gadgets, or hobbies

- Vacations and travel

While these expenses aren’t necessities, they enhance the quality of life. The key is to keep them within 30% of your income so they don’t interfere with savings and essential expenses.

20% for Savings and Debt Repayment

This portion is crucial for long-term financial stability. It includes:

- Emergency fund contributions

- Retirement savings (401(k), IRA, or other investments)

- Extra payments on loans to reduce debt faster

- Investing in stocks, real estate, or other financial assets

Prioritizing savings ensures financial security, while paying off debt faster reduces interest payments, ultimately saving you money.

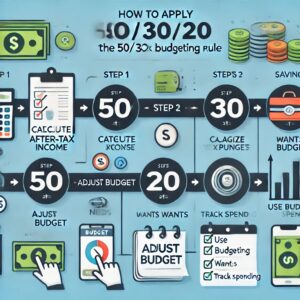

How to Apply the 50/30/20 Rule to Your Finances

- Calculate Your After-Tax Income – This is your take-home pay after taxes and deductions. If you’re self-employed, subtract estimated taxes from your income.

- Break Down Your Expenses – Categorize your spending into needs, wants, and savings/debt repayment.

- Adjust If Needed – If you’re spending too much in one category, make necessary adjustments to balance your budget.

- Use Budgeting Tools – Apps like Mint, YNAB, or even a simple spreadsheet can help track your spending and ensure you stay within the 50/30/20 framework.

- Stick to the Plan – Budgeting requires discipline. Review your budget regularly and make changes as your financial situation evolves.

Adjusting the Rule to Fit Your Lifestyle

The 50/30/20 rule is a great starting point, but it may not fit everyone’s financial situation perfectly. Here’s how you can tweak it:

- High Cost of Living Areas: If your rent is too high, your needs may take up more than 50%. In this case, adjust your wants and savings percentages.

- Paying Off Debt Aggressively: If you want to eliminate debt faster, consider shifting more from the wants category to debt repayment.

- Higher Savings Goals: If you’re saving for a house or early retirement, increasing the savings percentage to 25–30% might be beneficial.

- Variable Income: If your income fluctuates (freelancers, gig workers), prioritize a strong emergency fund and be flexible with your allocations.

Common Mistakes to Avoid

Even with a simple plan like the 50/30/20 rule, people often make mistakes, including:

- Misclassifying Wants as Needs – Dining out and premium subscriptions are wants, not needs. Stick to essential expenses in the needs category.

- Neglecting Savings – Some people prioritize wants over savings, which can lead to financial struggles later. Always pay yourself first.

- Not Adjusting for Life Changes – A raise, new expenses, or major life events require re-evaluating your budget.

- Failing to Track Spending – If you don’t track where your money goes, it’s easy to overspend in one category without realizing it.

Benefits of Using the 50/30/20 Rule

The 50/30/20 rule is widely recommended because of its many benefits:

- Simplicity – It’s easy to understand and apply, even for beginners.

- Balanced Financial Health – Ensures all aspects of money management—essentials, enjoyment, and savings—are covered.

- Flexibility – Can be adjusted to fit different income levels and financial goals.

- Encourages Smart Spending – Helps differentiate between wants and needs, preventing impulsive spending.

- Reduces Financial Stress – Provides a clear roadmap to managing money effectively.

Conclusion: Take Control of Your Finances

Mastering your finances doesn’t have to be overwhelming. By following the 50/30/20 rule, you can create a budget that is simple, effective, and sustainable. Whether you’re looking to gain control over spending, pay off debt, or build a strong financial future, this budgeting method offers a solid foundation. Take the first step today, track your income, allocate it wisely, and watch your financial health improve over time.

Remember, budgeting is not about restricting yourself—it’s about empowering yourself to make smarter financial choices. So, start now and take control of your financial future!

Click here Also : Credit Score: How to Achieve an 800+ Credit Score

2 thoughts on “The 50/30/20 Rule: A Simple Guide to Budgeting”