Table of Contents

Introduction

For decades, fixed-income instruments like time fixed deposits and bank FDs have been the backbone of conservative investment strategies in India. Considered a risk-free investment, they’ve been favored for their stability and predictable FD returns. But in 2025, the scenario is evolving. As inflation bites and interest cycles shift, many investors are reevaluating their choices. The spotlight now shifts towards bonds, which are proving to be more attractive on several fronts. This article explores the transformation in India’s fixed-income landscape, guiding you through what’s going wrong with FD interest rates and why bonds might be a better bet this year.

Are Fixed Deposits Losing Their Charm in 2025?

For decades, fixed deposits (FDs) have symbolized safety and stability in Indian households. However, the economic landscape in 2025 is reshaping investor confidence. Traditional time deposits and bank fixed deposits (FDs) are no longer the automatic choice for conservative investors. Despite being seen as a risk-free investment, they are starting to lag behind when it comes to meeting modern financial expectations.

One of the major pain points is the declining FD interest rates, which have remained stagnant or failed to keep pace with inflation. The result? Eroding FD returns that no longer deliver the real value they once promised.

Why Investors Are Rethinking Traditional Saving Options

In today’s volatile market, investors are exploring beyond conventional avenues. Many are moving away from fixed-income instruments due to limited growth potential and the increasing opportunity cost of locking funds. Instead, they are focusing on capital preservation with better earning potential.

While term deposits were once synonymous with stability, the emergence of government securities, corporate bonds, and debt instruments is driving change. These alternatives often offer more attractive returns while still aligning with conservative risk appetites.

The evolution of investment platforms, greater financial literacy, and awareness of long-term investment strategies are encouraging people to diversify their portfolios. This shift is leading them to consider more liquid and tax-efficient tools such as bond funds and high-yield bonds, which are gaining traction in 2025.

Fixed Deposits in 2025: What’s Going Wrong?

Traditional time deposits, once hailed for their safety and simplicity, are failing to keep up with current market demands. In 2025, FD interest rates offered by major banks remain largely stagnant, hovering below inflation levels. This has a significant impact on fixed deposits returns, eroding purchasing power over time.

Moreover, bank FDs are now being seen as less competitive compared to newer, more dynamic options. With central banks adopting a more cautious rate hike approach, investors find themselves locked into low-yield fixed-income instruments with limited upside. The perception of risk-free investment is no longer enough to justify their declining real returns.

Bonds: The Smarter Alternative This Year?

Bonds in 2025 are emerging as a clear alternative for those seeking better yields and greater portfolio diversification. Whether you’re looking at government bonds, corporate bonds, or tax-free bonds, the returns are currently more attractive than those offered by traditional time deposits.

Unlike bank FDs, bonds can be structured with variable interest rates, offering better hedges against inflation. Additionally, they provide the flexibility of secondary market trading — something fixed-income instruments like FDs lack.

Many savvy investors are shifting from FD interest rates to the more adaptive bond markets, recognizing the potential for both capital preservation and growth.

Comparative Insights

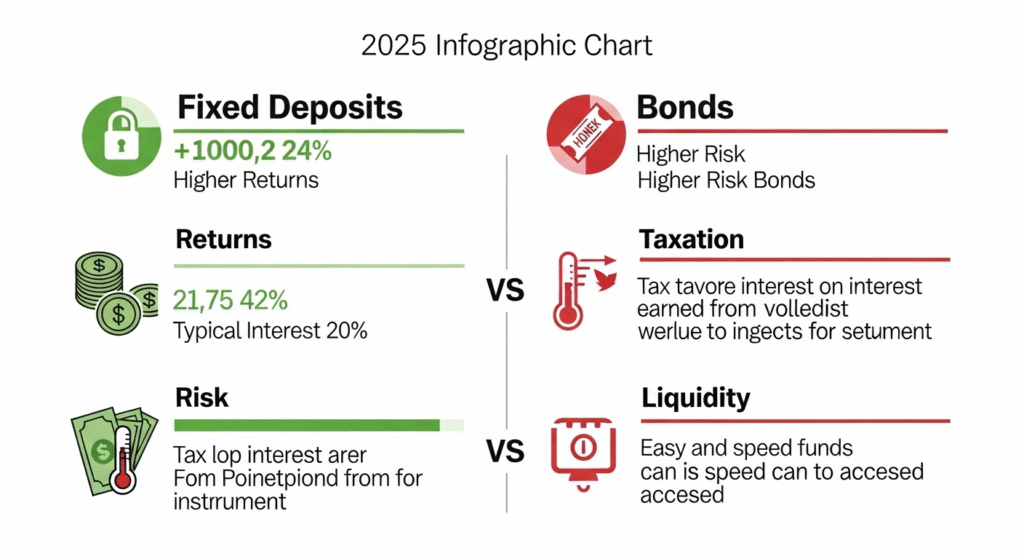

Let’s break it down:

| Feature | Fixed Deposits | Bonds |

|---|---|---|

| Returns | Fixed, low | Higher, varies with risk level |

| Liquidity | Locked-in | Tradable on markets |

| Risk | Low | Low to moderate (based on type) |

| Tax Efficiency | Fully taxable | Tax-free bonds available |

| Inflation Protection | Poor | Moderate to good |

Clearly, while bank FDs remain a risk-free investment, they fall short on inflation protection and liquidity.

Market Trends Driving the Shift

Several key factors are pushing investors away from time deposits and toward bonds in 2025:

- Persistently low FD interest rates due to conservative monetary policy.

- Rising inflation making FD returns less appealing in real terms.

- Increased awareness of diversified fixed-income instruments.

- Digitization and fintech platforms making bond investing more accessible.

- Growth of the Indian bond market, including retail participation in government securities.

As bond yields rise, traditional bank FDs look increasingly outdated, prompting even conservative investors to rethink their strategies.

Investor Perspectives

A recent survey among retail investors showed that over 60% are now considering corporate bonds or tax-free bonds over bank FDs. Many cited the lack of real returns from FD interest rates and the better post-tax returns from bonds as their primary reasons.

Young professionals and retirees alike are exploring fixed-income instruments beyond time deposits, seeking options that offer both safety and superior returns.

Actionable Insights

If you’re currently invested in bank FDs, here are some steps to consider:

- Compare returns: Evaluate your current FD returns versus those from available bonds.

- Check liquidity needs: Bonds offer flexibility through trading; ideal if you need access to funds before maturity.

- Review tax implications: Consider tax-free bonds for better post-tax yields.

- Diversify: Don’t abandon FDs entirely, but balance your portfolio with government or corporate bonds.

- Use digital platforms: Online bond marketplaces now simplify access to quality fixed-income instruments.

Conclusion

In 2025, fixed deposits are no longer the go-to option for maximizing returns. While still offering safety, they fall short in an environment where inflation and market conditions demand more agility. Bonds — from government securities to corporate offerings — are presenting themselves as the smarter alternative, delivering better yields and flexibility.

By rethinking your fixed-income approach and evaluating current FD interest rates against bond returns, you position yourself for stronger financial outcomes this year.

FAQ

1. Are bonds safer than fixed deposits?

While bank FDs are insured up to a limit, certain government bonds offer comparable or even better safety. Corporate bonds carry more risk but also offer higher returns.

2. Can I lose money investing in bonds?

Yes, especially in corporate bonds or if you sell before maturity in a volatile market. However, holding till maturity in quality bonds reduces risk significantly.

3. Are tax-free bonds better than FDs?

For those in higher tax brackets, tax-free bonds often provide better post-tax returns than time deposits.

4. How do I start investing in bonds?

You can use online platforms or consult a financial advisor. Start with government bonds for safety and gradually explore corporate bonds for yield.

5. Should I exit all my FDs now?

Not necessarily. Evaluate based on your goals. Consider gradually diversifying into bonds for a balanced fixed-income portfolio.