Table of Contents

Ethereum’s Quiet Resilience: Why Long-Term Holders Are Still Accumulating Amid Price Stagnation

ETH is not an exception to the recent resurgence of positive momentum in the cryptocurrency market. Ethereum is currently hovering just below $1,900 and has once again shown significant upward growth. ETH exchange supply is drastically decreasing, nevertheless, despite the encouraging price action, suggesting that investors are holding onto their tokens rather than trading them. Important questions concerning Ethereum’s current market situation and potential price trajectory are brought up by this change in investor behavior.

Ethereum’s Exchange Reserves Shrink: A Sign of Investor Conviction

Favorable market conditions have helped Ethereum’s price steadily rise, and the digital asset has now reclaimed the $1,800 milestone. Investors appear to be removing their Ethereum holdings from exchanges during this prosperous time, particularly from well-known sites like Binance, the biggest cryptocurrency exchange in the world.

The host of Crypto Banter, Kyle Doops, claims that ETH exchange supply is becoming much more limited. Doops verified that Ethereum is silently vanishing from exchanges by examining the Ethereum Exchange Supply Ratio indicator on Binance. This pattern suggests that a growing number of investors are choosing to save their Ethereum for the long term, which lowers the amount of ETH that is available for trade.

This conduct is indicative of a more general change in investor sentiment. by transferring ETH to long-term holdings or cold storage.

Tightening Supply Could Fuel Ethereum’s Bullish Momentum

Short-term price squeezes are made possible by the reduction in selling pressure that occurs when ETH is taken off of exchanges. According to research, Ethereum’s supply on exchanges has dropped to its lowest level in a number of weeks. Because decreased supply might result in increased demand and scarcity-driven price action, these regular supply reductions are frequently followed by price increases.

In particular, Kyle Doops noted that Binance has grown to be a significant ETH liquidity hub and that its function is essential to this tightening process. With traders and investors keeping a careful eye on the supply-demand balance, price changes are more likely as the available supply decreases.

Despite Bullish Moves, Ethereum Finishes Another Bearish Month

Ethereum’s latest positive trend notwithstanding, the asset has had difficulty sustaining long-term upward momentum. The price of ETH ended another month lower, continuing its downward trend. After suffering losses for several months, Ethereum investors have been concerned about this pattern of prolonged selling pressure.

In his analysis of ETH monthly price action, technical expert and investor Venturefounder noted that the cryptocurrency has experienced strong selling pressure for five months in a row. But when market attitude starts to change and ETH prognosis becomes more optimistic, May seems to be a watershed month. The current debate is whether Ethereum will continue its bearish cycle or if this upward momentum will be maintained.

Ethereum’s Struggle with Resistance and Low Volume

At the moment, ETH price is seeing strong opposition near the $1,900 mark. ETH has had difficulty convincingly breaking through local barrier levels, even with recent bullish price movement. These resistance levels are putting the asset, which is presently trading at about $1,825, to the test of its capacity to maintain upward momentum.

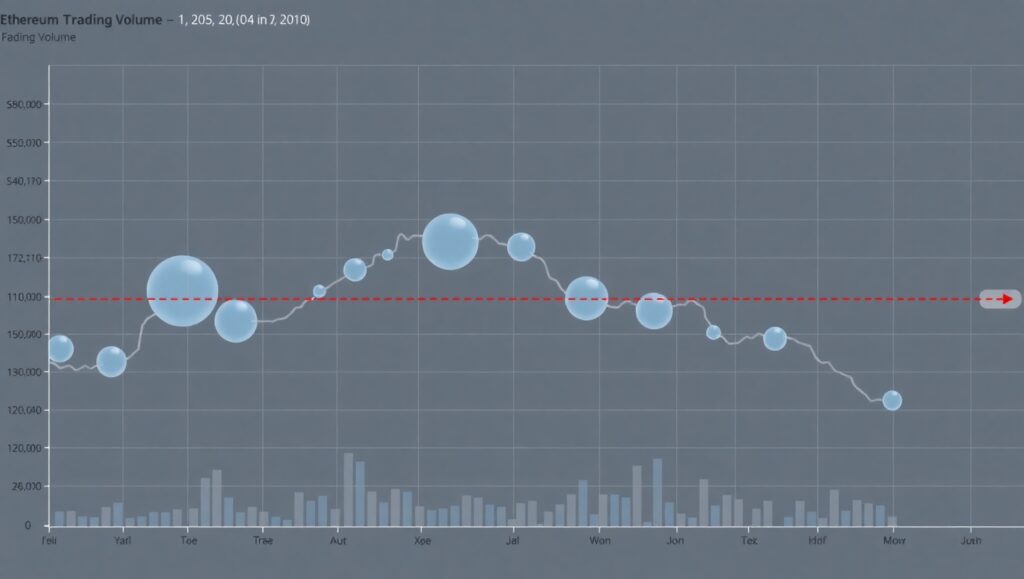

ETH trading volume is one of the main issues. The daily trading volume of ETH has fallen to all-time lows in recent weeks. This drop in volume is a well-known indicator of a market with unclear direction. The market seems to be waiting for a catalyst to set off the next big move, and both bulls and bears feel apprehensive.

A Closer Look at Ethereum’s Declining Spot Volume

One noteworthy development has been the decline in ETH spot volume. According to a bubble chart that CryptoQuant analyst Darkfost provided, Ethereum’s spot volume has been steadily dropping. The graph indicates that fewer trades are being made as the volume-representing bubbles get smaller and lighter in hue.

Darkfost views a reduction in spot volume as a stabilizing element, despite the fact that it is frequently interpreted as a sign of waning market interest. Lower volume can serve as a buffer during downtrends, lessening the possibility of significant sell-offs that could cause abrupt surges in volatility. This decreased activity may indicate that the market is stabilizing as sellers clear out their positions and move aside, fostering a more relaxed atmosphere that may lead to price stabilization.

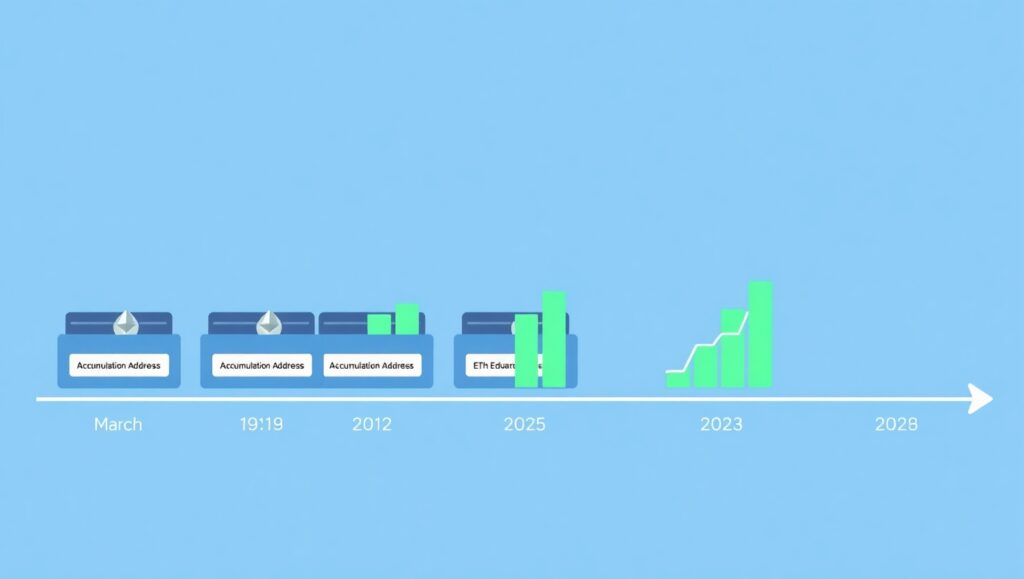

Long-Term Holders Continue to Accumulate, Even at a Loss

Long-term ETH holders have demonstrated a strong sense of conviction despite the cryptocurrency’s poor short-term performance. Carmelo Alemán, an analyst with CryptoQuant, emphasized the actions of long-term ETH owners, pointing out that many investors have kept accumulating Ethereum even as they wait on unrealized losses.

The number of accumulating addresses, or wallets that regularly accept ETH but infrequently sell, has increased. Alemán claims that between March and May, these addresses’ holdings grew by more than 22%, from 15.5 million ETH to 19 million ETH. This behavior implies that long-term holders are getting ready for potential price increases and shows a strong confidence that Ethereum is undervalued at current pricing.

Such accumulation has historically been a bullish indicator during times of price declines. as the market’s supply gets increasingly scarce.

ETH’s Future: A Matter of Patience and Conviction

With its trading volume at record lows and price resistance blocking any notable breakout, ETH is presently experiencing a period of price stasis. On-chain statistics, however, indicates that Ethereum’s long-term prospects are still favorable. Despite the present pricing difficulties, the decline in the supply of currency and the ongoing accumulation by long-term holders indicate that investors are setting themselves up for future gain.

The main conclusion is that Ethereum’s market behavior is probably changing. The asset gets scarcer as more ETH is taken off exchanges, which may pave the way for a big price spike when demand increases. Ethereum’s long-term prospects seem more promising than ever, even though short-term volatility may still be an issue.

Conclusion: Will ETH’s Bounce Back?

There are obvious indications of underlying strength even if ETH short-term price action has been difficult, with the asset going through multiple months in a row of losses and minimal volume. ETH’s is being amassed by long-term holders, and the exchange supply is still declining, indicating that a price squeeze may be imminent. As the market awaits the next significant move, the approach for Ethereum holders appears to be one of perseverance and faith.

Although the present lull may seem like a setback, ETH’s adventure in the cryptocurrency field is far from done, and it might be the quiet before the storm. As the market stabilizes, investors who believe in ETH long-term potential could profit.