Table of Contents

Imagine earning over £5,000 a year in passive income by the age of 35 — just by investing £60 per week starting at 21. With discipline, time, and the right investment choices, it’s entirely possible. This strategy leverages the power of compounding and dividend stocks to build long-term wealth — even for beginners with a modest weekly budget.

Let’s break down how this works and how you can take your first steps toward financial independence.

Why Passive Income Through Dividend Stocks Works

Passive income is money earned with little ongoing effort. One of the best-known ways to generate it is through dividend-paying stocks — shares that reward investors with a portion of the company’s profits.

This investment style is:

- Simple to understand.

- Flexible, regardless of your earn income level.

- Scalable, meaning it grows as your investments grow.

By investing consistently in quality dividend shares, even small weekly contributions can snowball into a reliable income stream over time.

Compounding: The Secret to Wealth Building

The real magic happens when you reinvest your dividends rather than withdrawing them. This is called compounding, and it’s one of the most powerful financial tools at your disposal.

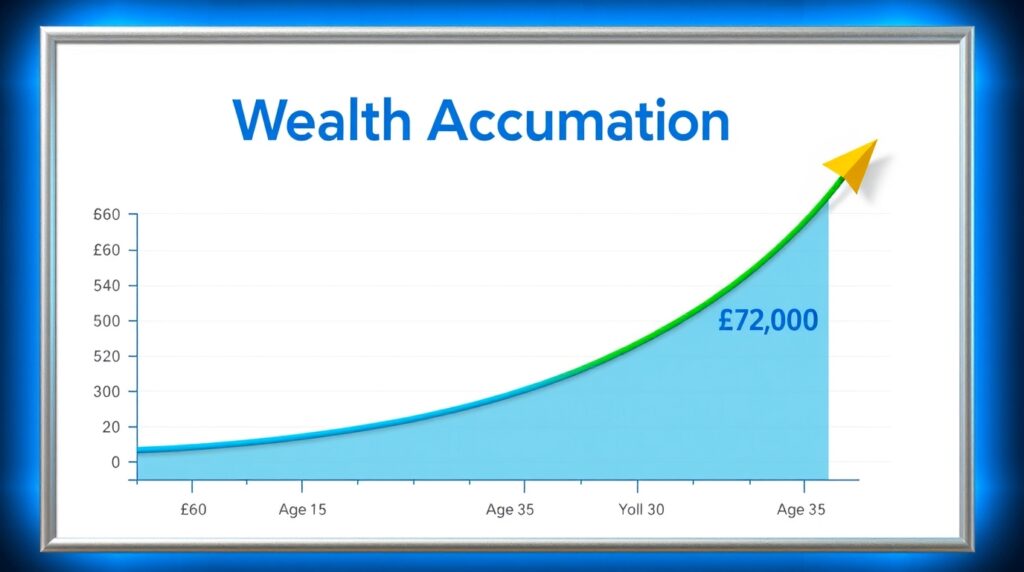

Let’s run the numbers:

- Weekly Investment: £60

- Annual Return (Compounded): 7%

- Time Period: 14 years (age 21 to 35)

By 35, your portfolio could grow to Earn £72,600+. If your portfolio yields a 7% annual dividend, you could earn over £5,083 in yearly passive income — without investing more money after age 35!

And this is just the beginning. If you continued investing past 35, your income and capital would grow even more.

How to Start Your Investment Journey

Starting your investment journey doesn’t require a finance degree. All you need is a willingness to learn, stay consistent, and take the first steps.

Step 1: Open an Investment Account

You’ll need a platform to begin investing. Consider these options:

- Stocks and Shares ISA – Tax-efficient and perfect for long-term investing.

- Trading Apps – Apps like Trading 212 or Freetrade are beginner-friendly.

- Share-Dealing Platforms – For those looking for more control and tools.

Step 2: Automate Your Contributions

Set up an automatic transfer of Earn £60 per week to your investment account. Automation ensures consistency, helping you build wealth effortlessly.

Step 3: Diversify Your Portfolio

Invest in different sectors such as energy, healthcare, consumer goods, and tech to spread your risk. A diversified portfolio helps you weather market volatility.

Step 4: Reinvest Dividends

Always opt to reinvest dividends, especially in the early years. This will maximize the compounding effect and accelerate your passive income growth.

Choosing the Right Dividend Stocks

All dividend stocks are not created equal. Look for companies that:

- Have strong free cash flow

- Show a history of consistent dividend payments

- Operate in stable, mature industries

- Have a sustainable payout ratio

Example: British American Tobacco (LSE: BATS)

One standout dividend stock is British American Tobacco, a FTSE 100 giant. It currently offers a 6.6% dividend yield and has increased its dividend every year for decades. Despite global declines in smoking, it continues to generate strong cash flow thanks to its global presence and expanding non-cigarette product line.

⚠ Risk Note: Cigarette usage is declining globally, and regulatory risks remain. However, its solid financials and brand value keep it attractive for income investors — at least for now.

Alternative Earn Dividend Stocks to Consider

Besides British American Tobacco, here are a few other dividend-paying stocks worth researching:

- Unilever (LSE: ULVR) – A household goods giant with stable cash flows and global demand.

- Legal & General Group (LSE: LGEN) – A high-yielding financial services company.

- National Grid (LSE: NG) – A utility stock with reliable income potential.

You can also consider Dividend ETFs that track a basket of dividend stocks, reducing your risk and exposure to individual companies.

Common Mistakes to Avoid

Even with the best strategy, it’s easy to make avoidable mistakes. Here are a few to steer clear of:

- Ignoring diversification – Don’t put all your money into one stock or industry.

- Chasing high yields blindly – A very high dividend yield could signal financial distress.

- Not reinvesting dividends – This limits the power of compounding.

- Panic selling during downturns – Stick to your long-term strategy.

Is This Strategy Right for You?

This investment plan is ideal for:

- Students and young professionals starting early.

- Anyone with a stable income looking to build passive income.

- Those aiming for financial freedom by mid-life.

It might not be suitable if you:

- Need short-term liquidity.

- Aren’t willing to leave your money untouched for several years.

- Can’t tolerate fluctuations in the market.

Expert Insight: Energy Investing Opportunities

While dividend investing is powerful, it’s also smart to keep an eye on emerging trends. Mark Rogers, Director of Investing at Motley Fool UK, has identified earn 5 energy stocks that could benefit from the global push toward energy independence and net-zero goals — changes accelerated by recent geopolitical tensions.

These companies are poised for long-term growth, and savvy investors could see big returns by entering early. While not all will pay dividends, combining income stocks with growth opportunities can balance your portfolio.

Final Thoughts: Small Steps, Big Earn Rewards

The idea that a 21-year-old could build £5,000+ in annual passive income by age 35 may sound far-fetched — but it’s not. By investing just earn £60 a week and staying consistent, this goal is within reach.

Start small, stay the course, and let time and compounding do the heavy lifting.

✅ Key Takeaways:

- £60/week from age 21 can grow to £72,600+ by age 35.

- Reinvesting dividends boosts growth through compounding.

- Dividend-paying stocks offer consistent passive income.

- Start with a Stocks & Shares ISA or trading app.

- Research stocks like British American Tobacco, Unilever, and National Grid.