Table of Contents

Stocks are a favorite among both new and seasoned investors. Why? They provide a steady stream of passive income while giving you the chance to benefit from the company’s growth. Whether you’re saving for retirement, growing your wealth, or diversifying your portfolio, dividend investing can be a powerful tool to help you achieve your financial goals.

Below, we’ll break down everything you need to know about stocks—from their benefits and risks to key strategies for picking the right ones. By the end, you’ll be ready to make informed decisions and take advantage of this smart investment strategy.

What Are Dividend Stocks and Why Are They Worth Your Attention?

Dividend stocks are shares of companies that distribute a portion of their profits to shareholders. These payments are usually made quarterly, though some companies offer them monthly or annually. Dividends are often quoted as either a fixed dollar amount per share or as a percentage (known as the dividend yield).

Here’s why dividend stocks stand out:

- Earn while you invest: Receive regular income without selling your shares.

- Compound growth: Reinvest dividends to grow your portfolio over time.

- Profit-sharing: Feel the rewards of being part of a company’s success.

Essential Terms You Should Know

Before jumping into dividend investing, make sure you’re familiar with these basic terms:

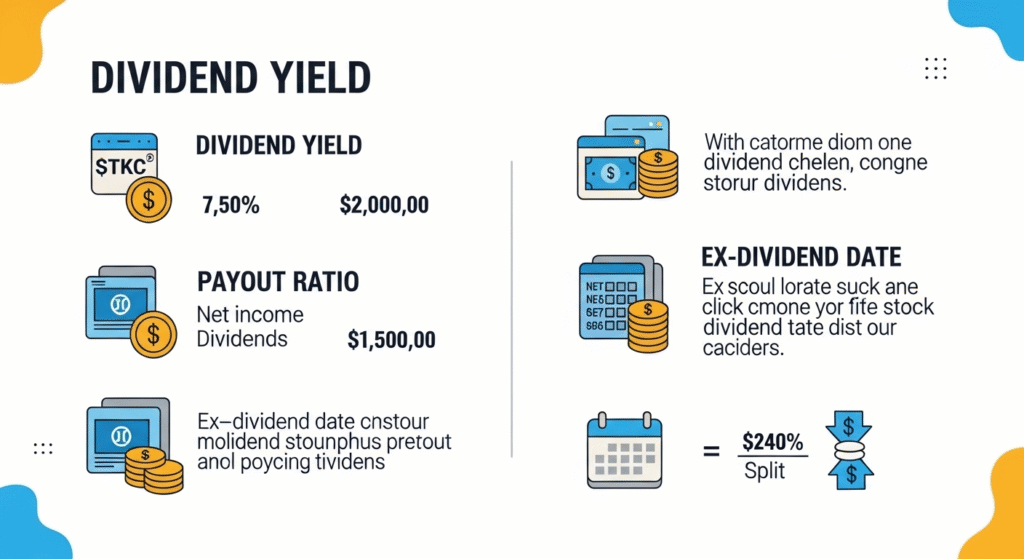

- Dividend Yield: This shows your return on investment based on dividends alone. It’s calculated as the annual dividend divided by the share price. A high yield can mean bigger payouts, but it might also point to risks.

- Formula: Annual Dividend ÷ Share Price = Dividend Yield

- Payout Ratio: This is the percentage of a company’s earnings paid out as dividends. Lower payout ratios often indicate more room for growth, while higher ones may signal potential challenges.

- Ex-Dividend Date: To qualify for the next payout, you need to own the stock before this date.

Knowing these terms will help you evaluate potential investments and make smarter decisions.

Three Big Benefits of Dividend Stocks

Investing in dividend stocks goes beyond earning income. Here’s why they deserve a spot in your portfolio:

- Reliable Passive Income

Dividend payments provide a consistent cash flow, making them ideal for retirees or anyone seeking additional income without selling assets.

- Long-Term Growth Potential

Many companies that pay dividends are financially stable, offering the chance for stock appreciation in addition to regular payouts.

- A Hedge Against Inflation

Unlike fixed-income investments, dividends can grow over time, helping your returns keep up with inflation.

Be Aware of These Risks

While dividend stocks offer many advantages, they do come with some risks:

- Market Volatility: Share prices and dividends can fluctuate based on broader market conditions.

- Company Challenges: If a company encounters financial issues, it could reduce or cut dividends altogether.

- Over-Concentration: Relying too heavily on a small number of dividend stocks in one sector can increase your risk exposure.

How to Choose the Right Dividend Stocks

Picking the best dividend stocks requires research and strategy. Here’s how to start:

- Look for Consistency

Choose companies with a history of stable or growing payouts. Dividend Aristocrats (companies that have grown their dividends for 25+ consecutive years) are a great place to start.

- Balance Yield and Payout Ratio

Don’t be lured by high yields without considering the company’s financial health. Aim for a yield that’s attractive but sustainable, paired with a payout ratio of 60% or below.

- Diversify Your Portfolio

Spread your investments across different industries (e.g., technology, energy, consumer goods) to minimize risk and maximize opportunities.

Don’t Forget About Taxes

Understanding how dividends are taxed can save you money. Here’s a quick breakdown:

- Qualified Dividends: Taxed at a lower long-term capital gains rate.

- Ordinary Dividends: Taxed as regular income at your usual tax rate.

Some ways to minimize your tax burden include:

- Utilizing tax-advantaged accounts like IRAs or 401(k)s.

- Prioritizing qualified dividends for their lower tax rate.

- Seeking guidance from a tax advisor to optimize your strategy.

Examples of Popular Dividend Stocks

While this is not financial advice, here are some dividend-paying companies often favored by investors:

- Johnson & Johnson (Healthcare): Known for dependable payouts.

- Coca-Cola (Consumer Goods): A Dividend Aristocrat with decades of increases.

- Procter & Gamble (Consumer Goods): A staple in countless households with steady dividends.

- Apple (Technology): Combines innovation with regular payouts.

- Enbridge (Energy): Recognized for a high yield, ideal for income seekers.

Always research thoroughly or consult a financial advisor before making any investment.

Why Dividend Investing Matters

Dividend stocks provide more than just income; they offer stability, growth, and a pathway to sustainable wealth. To make the most of investing:

- Research companies thoroughly.

- Build a diversified portfolio.

- Stay informed about financial and market trends.