Table of Contents

1. Introduction: Understanding Coinbase Stock and Its Significance in the Cryptocurrency Market

Coinbase, one of the leading cryptocurrency exchanges in the world, made its much-anticipated debut on the stock market recently. As the first major cryptocurrency company to go public, Coinbase’s stock has garnered significant attention from investors and the financial community alike. With the surging popularity of cryptocurrencies like Bitcoin and Ethereum, many are eager to learn more about Coinbase’s stock performance and what it means for the future of digital assets. In this blog, we will delve into the details of Coinbase’s stock, its impact on the cryptocurrency industry, and what investors can expect moving forward.

2. The Current Performance of Coinbase Stock: Analyzing Recent Trends and Market Movements

Following its initial public offering, Coinbase’s stock performance has been closely monitored by investors. The stock experienced volatile movements in its early days of trading, reflecting the fluctuations often seen in the cryptocurrency market. Despite this initial turbulence, Coinbase’s stock has shown resilience and demonstrated a steady upward trajectory as more investors flock to the platform. Understanding the factors influencing Coinbase’s stock price can provide valuable insights for both seasoned traders and newcomers looking to delve into the world of digital assets. In the next section, we will explore the recent trends and market movements shaping Coinbase’s stock performance and discuss what potential implications they may have for investors.

3. Key Factors Influencing Coinbase Stock: Market Conditions, Regulations, and Industry Competition

As Coinbase’s stock continues to attract attention in the market, it is crucial to delve into the key factors influencing its performance. Market conditions, including the overall cryptocurrency market sentiment, play a significant role in determining the stock’s trajectory. Furthermore, regulatory developments can impact Coinbase’s operations and investor sentiment. Keeping a close eye on industry competition and Coinbase’s positioning within the market can also provide valuable insights for investors. By understanding these factors, investors can make informed decisions when navigating the dynamic landscape of digital asset investments. Stay tuned as we explore the latest trends and updates shaping the future of Coinbase’s stock performance.

4. Investment Strategies: Evaluating the Pros and Cons of Investing in Coinbase Stock

When considering investing in Coinbase stock, it is essential to analyze the potential benefits and risks. Pros include exposure to the growing cryptocurrency market, Coinbase’s dominant position in the industry, and potential for significant returns. However, cons may encompass regulatory uncertainties, volatility in the crypto market, and competition from emerging platforms. Conducting thorough research, diversifying your portfolio, and consulting with financial advisors can help mitigate risks and optimize investment opportunities. Stay informed about market trends and Coinbase’s performance to make well-informed investment decisions. By carefully weighing the pros and cons, investors can navigate the complexities of the digital asset market and capitalize on opportunities wisely.

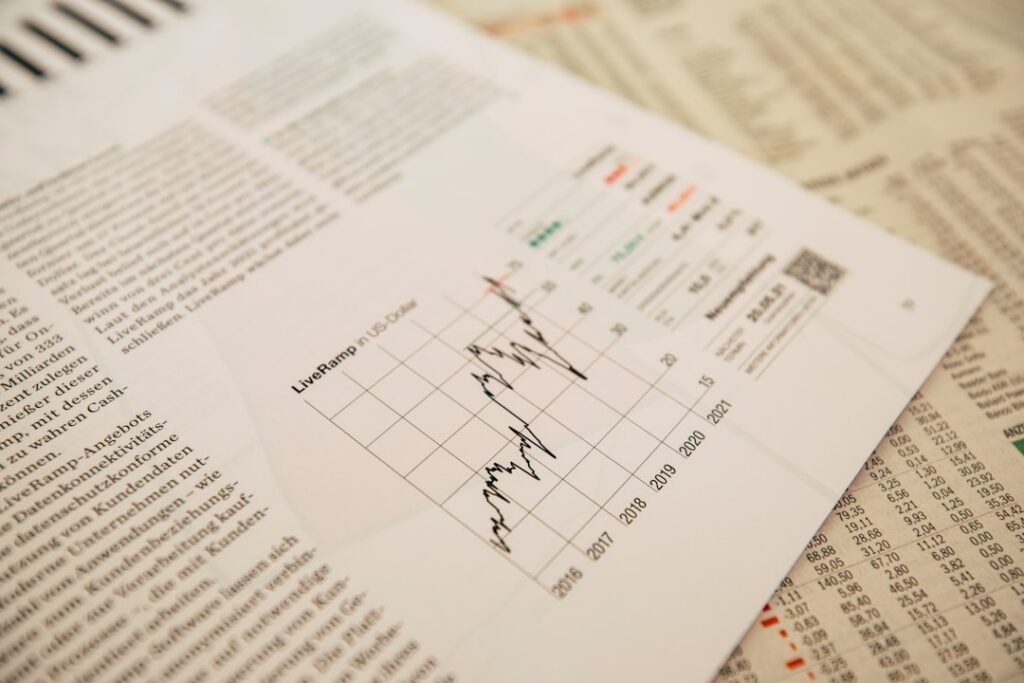

5. Technical Analysis: Insights into Price Movements and Forecasting Coinbase Stock Trends

Technical analysis involves examining historical price data and market activity to forecast future price movements. By utilizing charts, indicators, and patterns, investors can gain valuable insights into Coinbase stock trends. Understanding key technical indicators such as moving averages, support and resistance levels, and trading volumes can help investors make informed decisions about buying, selling, or holding their Coinbase shares. By incorporating technical analysis into your investment strategy, you can better anticipate potential price fluctuations and optimize your trading approach. Stay tuned for our upcoming blog post where we delve deeper into technical analysis and its application to Coinbase stock.

6. Conclusion: Making Informed Decisions on Coinbase Stock Investment

In conclusion, incorporating technical analysis into your investment strategy can greatly enhance your ability to make informed decisions regarding Coinbase stock. By analyzing historical price data and key technical indicators, you can gain valuable insights into potential price movements and optimize your trading approach. Understanding trends, support and resistance levels, and trading volumes is crucial for successful stock investing. By staying informed and utilizing technical analysis tools, you can navigate the dynamic market landscape and make well-informed decisions about buying, selling, or holding your Coinbase shares. Stay tuned for more valuable insights and tips on maximizing your investment potential with Coinbase stock.

Coinbase Stock Performance So Far

Since its IPO, COIN stock has had a wild ride. It opened at $381 but dipped below $40 during the 2022 crypto winter. In 2024, however, the stock rebounded strongly thanks to a Bitcoin bull run and growing institutional interest in crypto.

As of mid-2025:

- COIN trades around $250

- Market Cap: ~$50 billion

- 1-year return: +80%

Coinbase Stock Forecast 2025–2030

Analysts remain divided on COIN. Here’s a summarized projection:

| Year | Expected Price Range | Key Factors |

|---|---|---|

| 2025 | $220 – $300 | BTC ETF impact, trading rev |

| 2026 | $250 – $400 | Regulation clarity, growth |

| 2030 | $500+ | Institutional adoption boom |

📝 Note: These are speculative estimates based on current trends.

🙋♂️ Frequently Asked Questions

❓ Is Coinbase stock a good buy in 2025?

It depends on your risk appetite. If you’re optimistic about crypto adoption and don’t mind short-term volatility, Coinbase offers upside.

❓ Will Coinbase survive regulation?

As a publicly traded company, Coinbase is one of the few crypto exchanges actively trying to work within U.S. laws. But its future will depend on court outcomes in 2025–2026.

❓ Does Coinbase pay dividends?

No. Coinbase does not pay dividends — it reinvests profits into growth and platform development.