Table of Contents

Introduction: Demystifying Canadian Split Share Funds for Savvy Investors

In the dynamic world of investments, many individuals seek a dual promise: steady income to support their lifestyle and robust growth to build long-term wealth. Navigating this quest can often feel like a balancing act, requiring careful consideration of various financial instruments. For Canadian investors, a unique and increasingly popular vehicle has emerged to address these very objectives: the Canadian Split Share Fund. This investment structure is ingeniously designed to ‘Canadian split’ the returns from a single underlying portfolio, offering distinct pathways for different investor goals. At its core, a Split Share Fund typically invests in a curated basket of high-quality, dividend-paying companies and then issues two distinct classes of shares – Preferred shares and Class A shares – to investors.

While the allure of attractive income streams and magnified growth potential is undeniable, the intricate nature of Canadian Split Share Funds means that a superficial understanding can lead to unexpected pitfalls. These are not simple investments; they involve a unique interplay between different share classes and specific operational rules that demand thorough comprehension. Without a clear grasp of their mechanics, investors might inadvertently expose themselves to risks they are unprepared for. This comprehensive guide aims to equip readers with the essential knowledge needed to approach these funds with confidence, ensuring they can make informed decisions aligned with their financial aspirations.

To demystify this powerful investment tool, this article will delve into six core concepts that every potential investor needs to understand. Furthermore, it will conclude with two crucial reminders designed to help navigate the complexities and maximize the potential benefits of Canadian Split Share Funds. By the end, readers will have a clearer roadmap for incorporating these unique vehicles into their investment strategy.

Concept 1: What Exactly Are Canadian Split Share Funds? A Canadian Perspective

A Canadian Split Share Fund, often colloquially known as a ‘Split Corp,’ stands as a distinctive investment vehicle within the Canadian Split financial landscape. These corporations are specifically structured to provide attractive income and growth opportunities by investing in a diversified portfolio, predominantly composed of high-quality, dividend-paying Canadian Spilt stocks. Unlike conventional mutual funds or ETFs that offer a single class of shares representing a blended return, Canadian Split Corps disaggregate these returns to cater to varied investor appetites.

The ingenious ‘split’ mechanism is central to their operation. A Canadian Split Share Fund issues two primary classes of shares: Preferred Shares and Class A Shares. Both of these share classes are exchange-traded, meaning they can be bought and sold on stock exchanges just like any other common stock or ETF. The fund then strategically allocates the two main components of its underlying portfolio’s returns – the dividends generated by the stocks and any capital appreciation from those same securities – between these two distinct share types. This separation allows the fund to offer tailored risk-reward profiles from a single pool of assets.

One of the most compelling aspects of Canadian Split Share Funds is the flexibility they offer investors. Instead of being confined to a singular investment profile, individuals can choose the share class that best aligns with their specific financial objectives and personal risk tolerance. Some may opt solely for Preferred shares, others for Class A shares, and a segment might even choose to hold both to achieve a balanced exposure. This ability to customize exposure to income or growth from a single underlying portfolio is a significant differentiator.

The foundation of any Canadian Split Share Fund is its actively managed portfolio. These portfolios are typically constructed from a basket of high-quality, established Canadian companies renowned for their consistent dividend payments and stable performance. The strength and reliability of these core holdings are paramount, as they are the ultimate source of all returns distributed to both Preferred and Class A shareholders. It is also worth noting that Split Share Corporations are far from a new phenomenon in Canada. They are a well-established investment product, having been a part of the Canadian investment landscape since the 1990s. This long track record indicates a mature market and a proven structure, providing a degree of historical context for potential investors.

The fundamental innovation of Canadian Split Share Funds lies in their ability to effectively segment the market for a single underlying portfolio. By disaggregating the traditional equity return profile—income and capital appreciation—into two distinct components, these funds simultaneously attract both income-focused and growth-oriented investors. This structural design facilitates a more efficient aggregation of capital. It caters to diverse investor appetites that might otherwise invest in entirely separate asset classes, such as bonds for income or individual growth stocks for capital gains. This expands the potential capital pool for the underlying portfolio, making it easier for the fund to raise and manage assets. This approach is not merely another fund type; it represents a sophisticated financial engineering solution designed to bridge the gap between traditional equity and fixed-income investments, offering tailored risk-reward profiles that might not be available through direct investment in the underlying stocks or conventional funds.

Concept 2: Preferred Shares – Your Path to Stable Income

Preferred shares within a Canadian Split Share Fund are meticulously crafted to appeal to conservative, income-focused investors. For these individuals, the primary objective is often a steady, predictable cash flow coupled with a strong emphasis on capital preservation, rather than aggressive capital growth.

One of the most attractive features of Preferred shares is their provision of fixed, cumulative quarterly dividends. This means investors receive a consistent and predictable income stream, and crucially, any missed payments must be made up before Class A shareholders can receive any distributions. This cumulative feature adds a layer of security to the income stream. Furthermore, Preferred shareholders hold a priority claim on the fund’s assets. In the event of the fund’s liquidation or distribution, they are paid first – receiving their original issue price plus any accrued dividends – before Class A shareholders receive any proceeds. This senior claim provides a significant layer of downside protection, making them a more secure option in volatile markets.

For Canadian investors, an additional benefit is the tax efficiency of these dividends. Dividends received on Preferred shares are often designated as eligible Canadian Split dividends, which typically qualify for a more favorable tax rate compared to other income sources like interest from bonds or GICs. This can significantly enhance after-tax returns for income-seeking individuals. Historically, the market price of Preferred shares has also demonstrated greater stability and lower volatility compared to common stocks or the more dynamically priced Class A shares. This relative stability makes them a popular choice for retirees and others seeking reliable income supplements without excessive price fluctuations.

However, the stability and income focus of Preferred shares come with a notable trade-off: limited potential for capital appreciation. Beyond their fixed dividend payments, Preferred shareholders generally do not benefit from growth in the underlying portfolio of stocks, as any capital gains are primarily allocated to Class A shares. Due to their fixed term and stable income profile, Preferred shares also share many characteristics with traditional fixed-income investments. While this provides predictability, it also implies a lower growth potential compared to pure equity investments, which are designed to capture market upside.

The structure of Preferred shares within a Canadian split fund effectively positions them as a risk-mitigation mechanism for investors seeking income from equity portfolios. By prioritizing fixed income and offering a senior claim on the fund’s assets, they transform a portion of the inherent equity risk into a more bond-like, stable investment. This design makes equity-based funds accessible to a broader spectrum of conservative investors who might otherwise shy away from direct stock market exposure. The fixed and cumulative dividends ensure income consistency, while the priority claim means Preferred shareholders are first in line for distributions and capital repayment, with Class A shares absorbing initial losses. This structural seniority significantly reduces the Preferred shares’ direct exposure to the underlying stock market’s volatility, making their behavior more akin to bonds, particularly during market downturns. This highlights how financial engineering can create hybrid securities that strategically blend characteristics of different asset classes, optimizing capital formation for the underlying portfolio by appealing to a wider range of investor preferences.

Concept 3: Class A Shares – Amplified Growth Potential (and Risk)

In stark contrast to Preferred shares, Class A shares are specifically engineered for growth-oriented and risk-tolerant investors. Their core objective is to capture and, crucially, amplify the capital appreciation potential of the underlying investment portfolio, often alongside any residual income.

The primary allure of Class A shares is their enhanced growth potential. These shares are structured to receive all of the gains (or losses) from the entire underlying portfolio, including the portion of assets attributable to the Preferred shareholders. This unique arrangement provides a leveraged exposure to the underlying stocks, meaning a relatively modest gain in the overall portfolio can translate into a significantly magnified return for Class A shareholders. This structural leverage is achieved without the direct costs typically associated with borrowing money to amplify returns, making it a cost-efficient way to gain amplified market exposure.

Beyond capital gains, Class A shares may also offer higher income potential. They are entitled to any residual dividends generated by the underlying portfolio that exceed the fixed dividend commitment to Preferred shareholders. This means that in periods of strong underlying portfolio performance and robust dividend payouts, Class A shareholders can benefit from both magnified capital appreciation and additional income.

However, the inherent leverage that amplifies gains is a double-edged sword, and this is where the significant risk lies. While it can lead to impressive returns in a rising market, it equally magnifies losses during market downturns. This symmetrical amplification makes Class A shares considerably more volatile than Preferred shares or even direct investment in the underlying stocks, rendering them suitable only for investors with a robust risk tolerance and a clear understanding of the potential for substantial capital erosion. The Net Asset Value (NAV) of Class A shares is directly tied to the fluctuating performance of the underlying portfolio, meaning its value can vary considerably. A critical risk for Class A shareholders is the potential for their monthly distributions to be reduced or entirely suspended if the underlying portfolio’s performance is insufficient, or if certain NAV thresholds are breached, a concept that will be explored in detail later.

The amplification of returns (and losses) seen in Class A shares is not a result of the fund directly borrowing money, but rather a structural consequence of the fixed claim held by Preferred shares. Consider a scenario where a Canadian Split Share Fund unit is initially valued at $20, comprising $10 for a Preferred share and $10 for a Class A share. If the entire $20 portfolio gains, say, 5% ($1.00), the Preferred share’s value typically remains constant at its initial $10.00, as it does not participate in capital appreciation. Therefore, the entire $1.00 gain from the portfolio must accrue to the Class A share, which started at $10.00. This $1.00 gain on an initial $10.00 investment represents a 10% return for the Class A share, effectively doubling the portfolio’s 5% gain. This concentration of gains (or losses) onto the Class A portion is the essence of this structural leverage. The fixed, non-participating nature of the Preferred share’s capital is the direct source of this leverage for the Class A share. It is a form of internal financial engineering where one class of shares provides a stable base, allowing the other to be highly sensitive to underlying portfolio movements. This structural leverage is a powerful differentiator from simply owning the underlying stocks directly, offering investors a higher beta exposure to a specific basket of stocks without the explicit costs of margin borrowing. However, this comes with the inherent and often underestimated risk of equally magnified losses, demanding a higher degree of risk tolerance and understanding from Class A investors.

Concept 4: The Ingenious Mechanism of Structural Leverage

The ‘built-in’ or ‘structural leverage’ inherent in Class A shares is a cornerstone of Canadian Split Share Funds, distinguishing them from many other investment vehicles. This form of leverage is not achieved through traditional borrowing by the fund, which would incur interest costs. Instead, it is an intrinsic feature of the fund’s unique two-tiered share structure, providing a cost-efficient way to gain amplified exposure to the underlying portfolio’s performance.

To truly grasp how this mechanism operates, consider a hypothetical Canadian Split Share Corporation that issues one Preferred share and one Class A share, each initially priced at $10.00, combining for a total of $20.00 of capital invested in the underlying portfolio. If this underlying portfolio experiences a 5% gain, its total value increases from $20.00 to $21.00. Given that the Preferred share’s value typically remains constant at its initial $10.00 (as it does not participate in capital appreciation), the entire $1.00 gain from the portfolio is then allocated solely to the Class A share. This means the Class A share, which started at $10.00, now increases to $11.00. This represents a 10% gain for the Class A share ($1.00 gain on an initial $10.00 investment), effectively doubling the portfolio’s 5% gain.

However, this powerful leverage operates symmetrically. If the underlying portfolio were to decline by 5% (for instance, from $20.00 to $19.00), the Preferred share’s value would still remain at $10.00. Consequently, the entire $1.00 loss would be borne by the Class A share, resulting in its value dropping to $9.00 – a 10% decline. This magnification of losses is a significant risk factor that investors must fully comprehend.

Given this amplified risk profile, it becomes paramount for investors to conduct thorough due diligence on the specific underlying stocks held within the fund’s portfolio. The quality, stability, and growth prospects of these core holdings are not merely important; they are critical determinants of the Class A share’s performance. A strong, resilient underlying portfolio is essential to mitigate the magnified downside potential inherent in the Class A structure.

The ‘built-in leverage’ of Class A shares, while seemingly advantageous for amplified gains, can inadvertently create a psychological trap for investors. Because this leverage does not involve explicit borrowing costs or a direct loan that an investor consciously takes on, there is a tendency to underestimate the magnified risk being undertaken. The allure of amplified gains without the readily apparent ‘cost’ of borrowing can overshadow the stark reality of equally magnified losses. This structural feature implies that Class A shares are not suitable for passive investors who do not regularly monitor their holdings or possess a deep understanding of the underlying market dynamics. It shifts the burden of understanding and managing amplified risk onto the individual investor, who might not always be equipped for such vigilance. For those who do not fully grasp this mechanism, a seemingly ‘good investment’ can quickly devolve into ‘speculation’. This highlights a critical aspect of financial product design: how inherent structural features can subtly influence investor perception of risk. For Class A shares, the benefit of ‘cost-efficient leverage’ comes with the implicit cost of increased volatility and the imperative for heightened investor vigilance, making them a more sophisticated investment requiring active management than they might initially appear.

Concept 5: Decoding NAV: Premiums, Discounts, and What They Mean for You

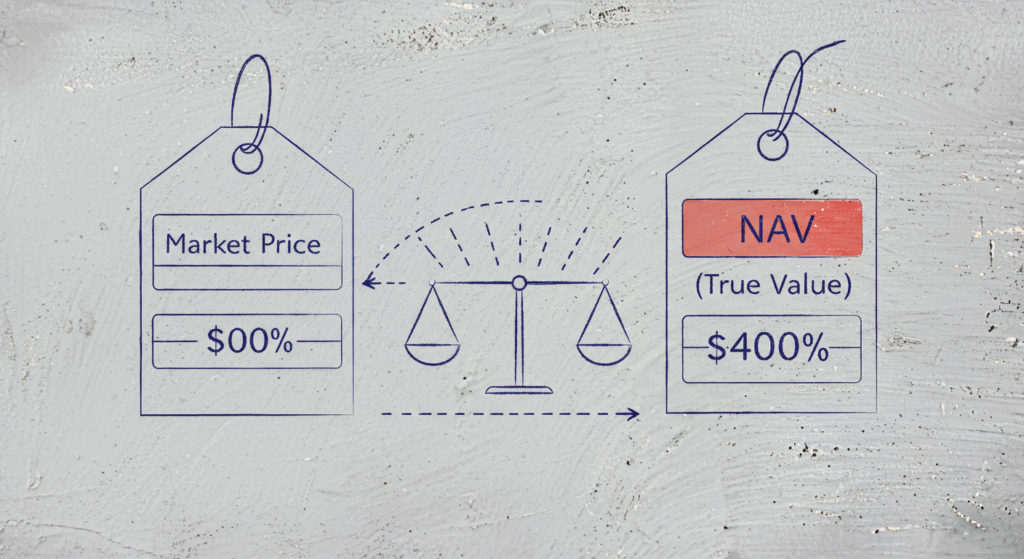

When evaluating any fund that trades on an exchange, it is crucial to understand the distinction between its Net Asset Value (NAV) and its market price. The NAV represents the true per-share value of the fund’s underlying assets. It is calculated by subtracting the fund’s liabilities from its total assets and then dividing by the number of outstanding shares. In essence, it’s the intrinsic value of the fund’s holdings. The market price, however, is the price at which the fund’s shares actually trade on a stock exchange throughout the day, and it is determined by the forces of supply and demand, much like any other stock.

The divergence between a fund’s market price and its NAV gives rise to what are known as premiums and discounts. A fund is said to be trading at a premium when its market price is higher than its NAV. This typically occurs when there is greater demand from buyers than available supply from sellers, often driven by strong investor sentiment towards the fund, its management, or a particularly popular underlying sector. Conversely, a fund trades at a

discount when its market price is lower than its NAV. This usually signifies more sellers than buyers, potentially indicating lower investor confidence, market inefficiencies, or a lack of liquidity.

Understanding these dynamics is vital for investors. Purchasing shares at a discount can be highly advantageous. Each dollar invested effectively buys more than a dollar’s worth of underlying assets. This can lead to an increased effective distribution rate on your investment and offers significant potential for capital appreciation if the discount narrows over time – meaning the market price moves closer to the NAV. Conversely, buying at a premium means paying more than the underlying assets are currently worth. While not inherently ‘bad’ if the fund’s performance remains strong, it can lead to diminished total returns if the premium shrinks or, worse, if the fund begins trading at a discount. Premiums and discounts are highly dynamic, heavily influenced by broader market sentiment, specific fund characteristics (such as performance and distribution rates), and the reputation of the fund manager. They can fluctuate widely, especially during periods of elevated market volatility or investor exuberance.

For more sophisticated analysis, the ‘z-score’ can be a valuable tool. This metric quantifies whether a fund’s current premium or discount is statistically significant compared to its historical average. A negative z-score suggests the fund is ‘cheap’ relative to its past valuation, potentially indicating a buying opportunity, while a positive z-score suggests it’s ‘rich’ and might warrant caution.

To illustrate the tangible impact of these market price deviations, consider the following hypothetical scenarios, which clearly demonstrate how an identical NAV growth can lead to vastly different investor returns based on the initial purchase price relative to NAV:

| Fund Scenario | Initial NAV | Initial Market Price | NAV Growth | Final NAV | Final Market Price (Assumed to converge to NAV) | Total Return |

| Fund ABC (10% Discount) | $10.00 | $9.00 | 10% | $11.00 | $11.00 | 22% (($11-$9)/$9) |

| Fund XYZ (10% Premium) | $10.00 | $11.00 | 10% | $11.00 | $11.00 | 0% (($11-$11)/$11) |

This illustration underscores a critical point: the fund’s underlying asset performance is only one piece of the puzzle. The price at which an investor acquires the Canadian Split shares, relative to their intrinsic value (NAV), significantly dictates the actual total return received. This means that monitoring premiums and discounts is as crucial as evaluating the fund’s fundamental performance, empowering investors to seek opportunities to enhance returns by buying at a discount and to exercise caution when considering purchases at a premium.

Concept 6: The Critical NAV Per Unit Rule: Protecting Your Investment

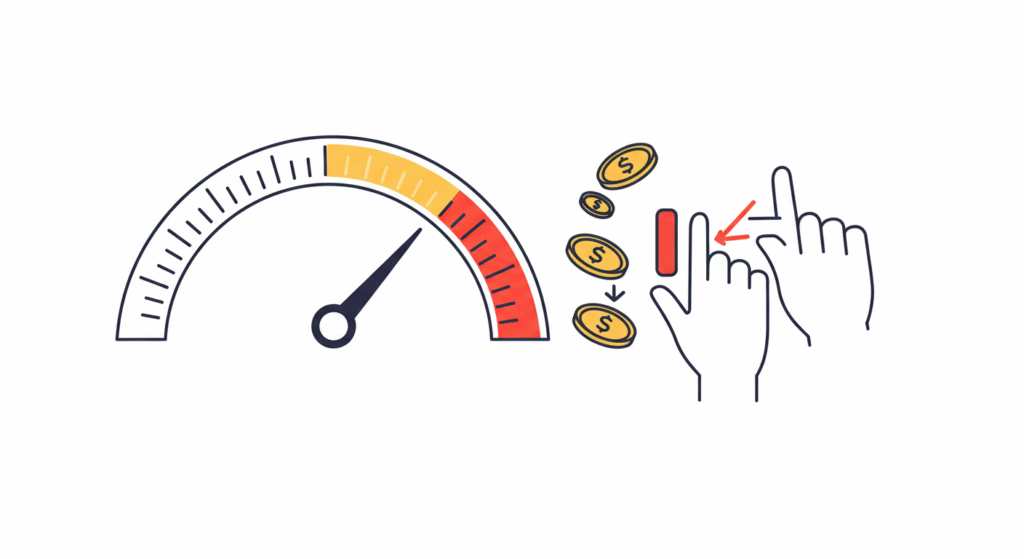

A defining characteristic and crucial safeguard within many Canadian Split Share Funds is the implementation of a critical Net Asset Value (NAV) per unit threshold. This rule serves as a crucial safeguard, primarily designed to protect the capital and income stream of Preferred shareholders by ensuring the fund maintains sufficient asset coverage to meet its senior obligations. It acts as an automatic circuit breaker, preventing the fund’s asset base from eroding below a certain point.

The direct and most significant consequence of this rule is felt by Class A shareholders. If the fund’s NAV per unit falls below the specified threshold – for instance, $15.00 for some Brompton funds or CAD 25 for Dividend 15 Split Corp II – the distributions to Class A shareholders are automatically suspended. This mechanism ensures that capital is retained within the fund rather than being paid out, thereby shoring up the fund’s asset base. This suspension directly reinforces the priority claim of Preferred shares, as the fund prioritizes preserving assets to meet its obligations to them.

This rule starkly illustrates the inherent priority claim of Preferred shares over Class A shares. For Class A shareholders, it means their anticipated income stream is conditional and directly exposed to the fund’s overall performance relative to this NAV threshold. It transforms their investment from a consistent income source into a pure capital appreciation play (or loss mitigation scenario) during periods of underperformance. For Preferred shareholders, this rule offers an additional layer of capital protection, ensuring that the fund’s assets are preserved to meet their senior claims, even if it means sacrificing Class A distributions.

It is important to note that Class A distributions are typically reinstated once the fund’s NAV per unit recovers and consistently remains above the specified threshold. This recovery signals improved financial health and a renewed ability to comfortably cover both Preferred share obligations and Class A distributions.

The NAV per unit rule serves as a direct and automatic mechanism for structural capital preservation within the split share fund. Its primary effect is to compel a suspension of Class A distributions, thereby retaining capital within the fund when the asset base is deemed insufficient to comfortably cover the senior obligations to Preferred shareholders. This directly reinforces the priority claim of Preferred shares and their inherent downside protection. The rule acts as an automatic circuit breaker: when the fund’s health deteriorates (i.e., NAV drops), it prioritizes the fund’s long-term viability and, by extension, the interests of its most senior claimants (Preferred shareholders), by sacrificing Class A shareholder income. This makes the Class A income stream explicitly conditional on the fund’s overall financial health. This highlights the sophisticated risk management embedded within split share fund structures. While it provides a layer of security for Preferred shareholders, it simultaneously introduces a specific, quantifiable risk to the income reliability for Class A investors. Understanding this rule is paramount for Class A investors, as it dictates when their expected income might cease, turning a perceived ‘income’ investment into a pure capital appreciation play or a loss mitigation scenario.

Reminder 1: Look Beyond the Ticker – The Power of Underlying Holdings

It is easy to become captivated by the unique structure, attractive yields, and leveraged growth potential of Split Share Funds. However, a crucial reminder for every investor is that your investment is fundamentally in the underlying basket of high-quality, dividend-paying companies that the fund holds. The Canadian split share fund itself is, in essence, merely a financial wrapper that organizes and distributes the returns generated by these core holdings.

Therefore, it is paramount to conduct thorough due diligence on the individual companies held within the fund’s portfolio. Their financial health, consistency of dividend payments, competitive positioning, and long-term growth prospects are the ultimate drivers of the split fund’s performance. These underlying fundamentals directly influence both the potential for capital appreciation for Class A shares and the fund’s ability to consistently generate enough income to fund Preferred share dividends.

Failing to analyze the underlying holdings can lead to significant and unexpected losses. For Class A shares, poor performance or a decline in the value of the underlying companies will be magnified due to the inherent leverage. For Preferred shares, a severe downturn in the underlying portfolio or, critically, dividend cuts by the underlying companies, could jeopardize their fixed payments, as these are directly sourced from the portfolio’s income. This is why some market observers caution that poorly understood split shares can turn ‘good investments into speculations’.

While your due diligence is key, it is also important to remember that the fund manager actively selects and manages this underlying portfolio. Their expertise in choosing stable, resilient, and consistently dividend-paying companies is critical to the fund’s long-term success and its ability to meet its distribution objectives for both share classes.

Investing in Canadian split share funds necessitates a dual-layered analytical approach. It is not sufficient to understand only the split share’s unique structure—its yield, leverage, and NAV rules. One must also perform fundamental analysis on the underlying companies within the portfolio. Over-focusing on the wrapper without scrutinizing its contents is a common investor pitfall that can lead to significant disappointments. A split share fund is a financial construct built upon a foundation of individual stocks. The performance characteristics of the split shares—income, growth, and volatility—are directly derived from the performance of these underlying assets. For example, if the underlying companies cut dividends, the preferred shares’ income could be jeopardized, and the Class A shares’ residual income would suffer. Similarly, if the underlying stocks decline significantly, the Class A shares’ leverage will amplify these losses. The split share structure distributes and repackages the risk and return of the underlying portfolio, but it does not insulate investors from the fundamental health or risks of those underlying companies. Investors must evaluate the fund’s holdings as if they were buying them directly, then overlay their understanding of how the Canadian split share structure modifies those returns and risks. This emphasizes that split shares, despite their innovative structure, are not a magic bullet that bypasses the need for fundamental investment analysis. The quality of the underlying equity remains the primary determinant of long-term success and risk, reinforcing the timeless principle that ‘an investment in knowledge pays the best interest’.

Reminder 2: Considering All-in-One ETFs for Simplicity and Diversification

While individual Canadian Split Share Funds can offer targeted exposure and unique benefits, their intricate mechanics can be daunting for many investors. Grappling with specific NAV rules, understanding term extensions, and navigating the nuances of Preferred versus Class A shares requires a significant time commitment and a deep dive into financial literature.

For investors who desire exposure to the Canadian split share market but prefer to bypass the complexities of individual fund analysis, all-in-one split share ETFs present a compelling and simpler alternative. These ETFs adopt a ‘fund of funds‘ approach, investing in a diversified portfolio of various underlying split share corporations. This allows investors to gain broad exposure to the asset class without needing to scrutinize each individual split fund.

One of the primary benefits of these all-in-one ETFs is professional management. Funds like those offered by Brompton are managed by experienced teams specializing in split share funds, bringing expertise in portfolio selection, risk management, and market navigation. Furthermore, by holding a basket of different split share funds, these ETFs inherently provide superior diversification. This significantly reduces the single-fund risk associated with investing in just one split share corporation, spreading exposure across multiple managers and underlying portfolios.

Like other Exchange Traded Funds (ETFs), these all-in-one solutions offer ease of access and trading. They are readily available on major exchanges, making them simple to buy and sell through a standard brokerage account. Crucially, some all-in-one Class A ETFs are specifically designed to manage the NAV per unit rule more effectively than individual funds, aiming to deliver consistent monthly income and mitigate the risk of dividend suspensions often seen in individual Class A shares. This can provide a greater sense of income reliability for investors.

Prominent Canadian Spilt providers, such as Brompton, offer these types of all-in-one solutions. Examples include the Brompton Split Corp. Class A Share ETF (CLSA) for those seeking amplified growth exposure, and the Brompton Split Corp. Preferred Share ETF (SPLT) for investors prioritizing income-focused exposure.

To help investors weigh their options, the following table provides a concise comparison of the key features, advantages, and disadvantages of investing in individual split share funds versus their all-in-one ETF counterparts:

| Feature | Individual Split Share Funds | All-in-One Split Share ETFs |

| Complexity | High; requires deep understanding of structure, NAV rules, etc. | Lower; diversified exposure simplifies analysis |

| Control | Direct control over specific underlying portfolios and fund mechanics. | Less direct control; relies on ETF manager’s selection. |

| Diversification | Lower; concentrated risk in one fund’s underlying portfolio. | Higher; diversified across multiple split funds. |

| Risk of Missed Class A Dividends | Higher; directly exposed to individual fund’s NAV rule breaches. | Potentially lower; designed to mitigate this risk for consistency. |

| Liquidity | Can be lower for some individual funds. | Generally higher due to broad market trading. |

| Management Fees | Varies by fund; direct fees on the single fund. | Incurs ETF management fees (generally lower than active mutual funds). |

| Potential for Highest Returns | Potentially higher if a single fund is perfectly selected and performs exceptionally. | May not capture the absolute highest returns of a single, top-performing individual fund. |

| Ease of Access | Requires research into specific funds and their offerings. | Simple to buy/sell like any other ETF. |

This comparison offers a clear framework for investors to assess which approach aligns best with their knowledge level, risk tolerance, and time commitment. For those who find the direct approach too complex, all-in-one ETFs provide a professionally managed and diversified entry point into the Canadian split share market.

Other Key Considerations

Understanding Term Extensions and Maturity Dates

Canadian Split Share Funds are typically established with a fixed term, often around five years, culminating in a defined maturity date. As this maturity date approaches, the fund may either be wound up, returning capital to shareholders, or its term may be extended for another period. In the event of a term extension, Preferred shareholders are usually granted an additional retraction right, allowing them to tender their shares and receive a retraction price based on the Net Asset Value (NAV) as of a specified valuation date. This offers a crucial liquidity event and a choice for investors who may not wish to continue holding their investment. For Preferred shares, the dividend rate is also typically reset at competitive market rates at the end of each term. This reset can significantly impact future income, and investors should be aware that if they were relying on the issuer to redeem their shares, they might be compelled to hold the issue for another term unless they sell on the open market. This periodic re-evaluation and potential for a new fixed dividend rate adds a layer of complexity and active management for the investor, demanding engagement at these reset/maturity points.

Overnight Offerings and Their “Non-Dilutive” Nature

From time to time,Canadian Split Share Funds may undertake what are known as ‘overnight offerings’. These are mechanisms for the fund to issue new Preferred and Class A shares to raise additional capital, which is then typically invested in the underlying portfolio to expand its asset base. A key aspect of these offerings is that they are often structured to be ‘non-dilutive to the most recently calculated net asset value per unit’. This means that the offering price for the new shares is set at a level that does not immediately reduce the underlying value per existing share for current shareholders. While the total number of shares outstanding increases, the

value per existing unit (based on underlying assets) is maintained at the time of the offering. This differs from a dilutive offering where new shares are issued at a price that would immediately reduce the value per share for existing holders. This mechanism allows the fund to grow its asset base without immediately penalizing existing shareholders on a per-unit NAV basis. However, it is important for investors to understand that increasing the share count can still impact market dynamics, such as supply and demand, and potentially affect market price performance in the short term, even if the NAV per unit is not immediately diluted. The term ‘non-dilutive’ in this context refers to a specific financial metric (NAV per unit) at a specific point in time, not necessarily a guarantee against all forms of future market impact.

Conclusion: Empowering Your Split Share Fund Journey

Canadian Split Share Funds present a fascinating and potentially rewarding avenue for investors seeking to tailor their exposure to income and growth from a basket of high-quality Canadian equities. These unique structures offer distinct advantages, from the stable, priority-claimed income of Preferred shares to the amplified growth potential (and inherent volatility) of Class A shares. Understanding concepts like structural leverage, the critical role of NAV premiums and discounts, and the protective NAV per unit rule is not merely academic; it is fundamental to navigating these investments successfully. Furthermore, remembering to look beyond the ticker symbol to scrutinize the underlying holdings is paramount, as the health of these core companies ultimately dictates the fund’s performance.

For those who find the intricacies of individual Canadian split share funds too complex, the emergence of all-in-one split share ETFs offers a simpler, diversified, and professionally managed alternative. Ultimately, the decision to invest in Canadian Split Share Funds – whether individual shares or through an ETF – should align with one’s personal investment objectives, risk tolerance, and capacity for due diligence. As with any investment, prudence is key. While the potential for amplified returns and consistent income is attractive, it is crucial to proceed with caution and a thorough understanding of the risks involved. For any investor considering these sophisticated instruments, consulting a qualified financial advisor is strongly recommended. Their expertise can help assess individual circumstances and ensure that any investment decisions are well-informed and strategically sound.