Table of Contents

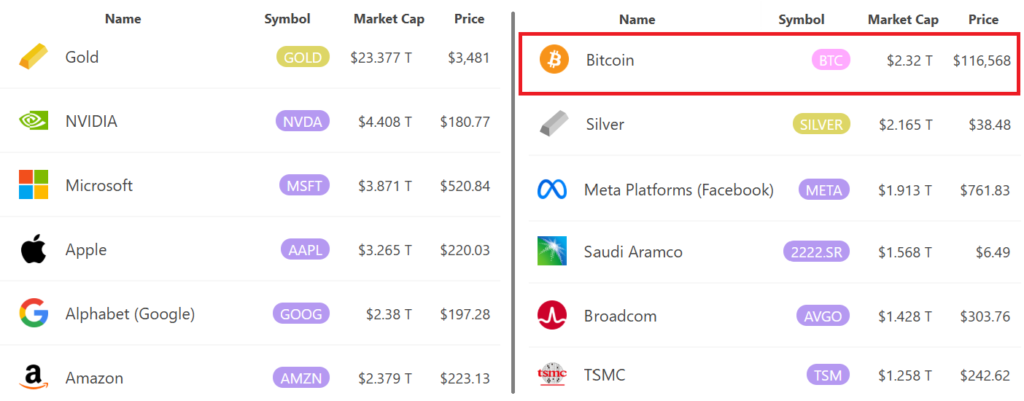

In 2025, Bitcoin’s price could be heavily influenced by the growth of the global money supply, the adoption of ETFs, and the influx of retail investments.

Introduction: Understanding the Potential of Bitcoin’s Next Rally

The cryptocurrency market has witnessed remarkable volatility throughout its history, but seasoned analysts believe that Bitcoin is positioned for an unprecedented surge that could propel it beyond the $122,000 mark. This ambitious price target isn’t merely speculation—it’s grounded in three fundamental catalysts that are reshaping the entire digital asset landscape.

Bitcoin has evolved from an experimental digital currency conceived by the enigmatic Satoshi Nakamoto to a legitimate store of value that commands respect from traditional financial institutions. The original white paper published over a decade ago outlined a vision that many dismissed as unrealistic, yet today’s market dynamics suggest that Bitcoin’s true potential is only beginning to unfold.

Understanding how Bitcoin works requires recognizing that it operates on a distributed ledger system that eliminates the need for centralized control. This revolutionary approach to monetary transactions has attracted millions of investors worldwide, with many now holding Bitcoin as a hedge against inflation and economic uncertainty.

Important points:

Image credit: https://cointelegraph.com

A rapidly growing global economy has become one of the main driving factors for Bitcoin.

The ETF for Bitcoin’s spot could exceed gold holdings remarkably, enhancing Bitcoin’s utility as a reserve asset.

Retail money flow is currently low, but if mainstream interest returns, we may witness a surge rally.

Bitcoin

BTC As of 23 July, Bitcoin’s selling price is $120000 as such we may expect certain traders expect Bitcoin to experience an all-time high again this year.

The main uncertainty is set on the global economy, and how sustainable the AI sector is.

Even then, three driving factors for the near to medium term seem to support Bitcoin’s price well above the 2.3 trillion dollar market cap.

Certain analysts forecast that Bitcoin will exceed gold’s valuation of $23 trillion. However, some analysts stress that a complete decoupling from technology stocks will take a lot longer due to adoption being in its early phases.

Regardless of whether or not sentiment shifts, the increased perception of gold, coupled with the investment landscape, creates room for a paradigm shift. Nvidia (NVDA) might be indicating that shift.

Catalyst 1: Institutional Adoption and Investment in Bitcoin

The first major catalysts driving Bitcoin toward unprecedented heights is the massive influx of institutional capital. Large corporations and investment funds have begun treating Bitcoin as a legitimate asset class, moving far beyond the early adopter phase that characterized the cryptocurrency market’s infancy.

Financial institutions that once dismissed Bitcoin as a speculative bubble are now incorporating it into their portfolios. This shift represents more than just a change in sentiment—it reflects a fundamental recognition that blockchain technology offers genuine value proposition that traditional financial systems cannot replicate.

The process of investing in cryptocurrency has become increasingly sophisticated, with institutional players developing comprehensive strategies that account for Bitcoin’s unique characteristics. Unlike retail investors who might make emotional decisions, institutional adoption brings stability and long-term commitment to the market.

Credit cards companies and payment processors have also begun integrating cryptocurrency solutions, making it easier for everyday consumers to participate in the Bitcoin ecosystem. This mainstream adoption creates a virtuous cycle where increased accessibility drives higher demand, which in turn attracts more institutional interest.

Catalyst 2: Technological Advancements and Network Upgrades

The second catalysts lies in the continuous evolution of Bitcoin’s underlying technology. The Bitcoin network has undergone significant improvements that enhance its scalability, security, and utility, making it more attractive to both individual and institutional users.

Open source development has been crucial to Bitcoin’s success, allowing thousands of developers worldwide to contribute to its improvement. This collaborative approach ensures that the network remains resilient and continues to evolve in response to changing market demands and technological opportunities.

Recent upgrades have addressed many of the concerns that previously limited Bitcoin’s mainstream adoption. These improvements have made cryptocurrency transactions more efficient and cost-effective, removing barriers that once deterred potential users from participating in the ecosystem.

The distributed ledger technology that powers Bitcoin continues to inspire innovations across multiple industries. As more applications are built on top of blockchain technology, the underlying value proposition of Bitcoin becomes increasingly apparent to market participants.

Catalyst 3: Regulatory Clarity and Global Acceptance

The third catalysts represents perhaps the most significant long-term driver: the gradual emergence of clear regulatory frameworks that legitimize Bitcoin as legal tender in various jurisdictions. This regulatory clarity reduces uncertainty and encourages broader participation from both individual and institutional investors.

Some countries have already declared Bitcoin as legal tender, setting precedents that other nations are likely to follow. This official recognition validates Bitcoin’s role as a legitimate monetary instrument and provides the legal certainty that many institutions require before making significant investments.

Social media platforms and online communities have played a crucial role in educating the public about Bitcoin and cryptocurrency in general. This grassroots education effort has helped dispel many misconceptions while highlighting the genuine benefits that Bitcoin offers over traditional financial systems.

However, the regulatory landscape also presents challenges, particularly regarding cryptocurrency scams and fraudulent schemes that exploit less informed investors. Proper regulation helps protect consumers while allowing legitimate cryptocurrency projects to flourish.

Bitcoin is traded as if it’s Nvidia, Strategy, and Metaplanet all rolled into one.

Even though Nvidia’s latest quarterly net income was stagnant relative to six months prior, its valuation increased from 2.3trillionto2.3trillionto4.4 trillion in March.

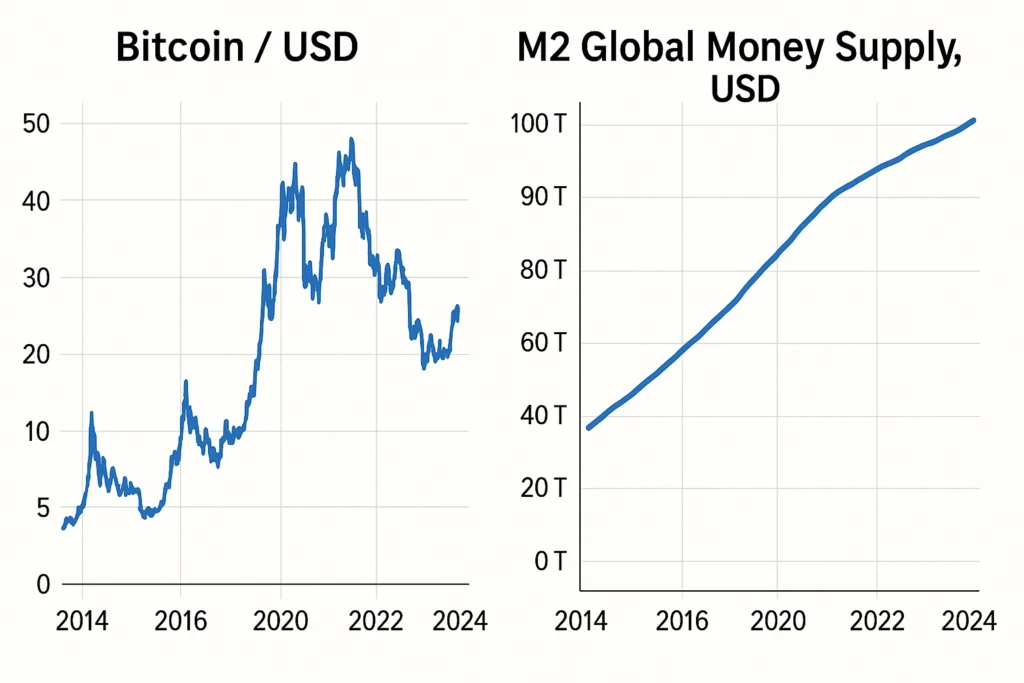

Traders may be speculating Nvidia’s earnings will far surpass expectations, or valuation metrics may be losing relevance with expectations of government-directed monetary easing as a result of escalating fiscal debt.

In July, the M2 global money supply across 21 of the largest central banks reached an all-time high of 55.5trillion,while the federal budget defic it of the United States was sitting at 55.5trillion,while the federal budget defic it of the United States was sitting at1.3 trillion over 9 months.

Even with Bitcoin’s BTC’s relatively strong correlation with tech stocks, these conditions present Bitcoin bulls with the best of opportunities.

Although retail inflows are still largely absent, Bitcoin’s 116% gains over the past year signals a changing tide.

The M2 global money supply is the difference alongside the S&P 500’s 22% annual return which is a magnet for new capital. This is particularly true as bitcoin gains traction in the mainstream with Strategy (MSTR) and MetaPlanet (MTPLF) making headlines.

The Impact of These Catalysts on Bitcoin’s Price Trajectory

When these three catalysts work in combination, they create a powerful momentum that could easily propel Bitcoin beyond the $122,000 threshold. The synergistic effects of institutional adoption, technological advancement, and regulatory clarity address the primary concerns that have historically limited Bitcoin’s growth potential.

Bitcoin cash and other alternative cryptocurrencies may benefit from this overall market expansion, but Bitcoin remains the dominant force that drives sentiment across the entire cryptocurrency sector. The white paper vision articulated by Satoshi Nakamoto appears increasingly prescient as these developments unfold.

The combination of technological innovation, institutional acceptance, and regulatory support creates an environment where Bitcoin can achieve sustainable growth rather than the boom-and-bust cycles that characterized its earlier years. This maturation process is essential for Bitcoin to reach and maintain price levels that seemed impossible just a few years ago.

Conclusion: Prepare for a New Era in Cryptocurrency with Bitcoin at the Helm

The convergence of institutional adoption, technological advancement, and regulatory clarity represents a perfect storm of positive factors that could drive Bitcoin to unprecedented heights. While the $122,000 target might seem ambitious, the fundamental changes occurring within the cryptocurrency ecosystem suggest that such valuations are not only possible but increasingly probable.

Investors who understand these catalysts and position themselves accordingly may find themselves well-prepared for Bitcoin’s next major rally. The private key to success lies in recognizing that Bitcoin has evolved far beyond its origins as an experimental digital currency to become a legitimate component of the global financial system.