Table of Contents

Introduction: Overview of AMD’s Performance in Q2

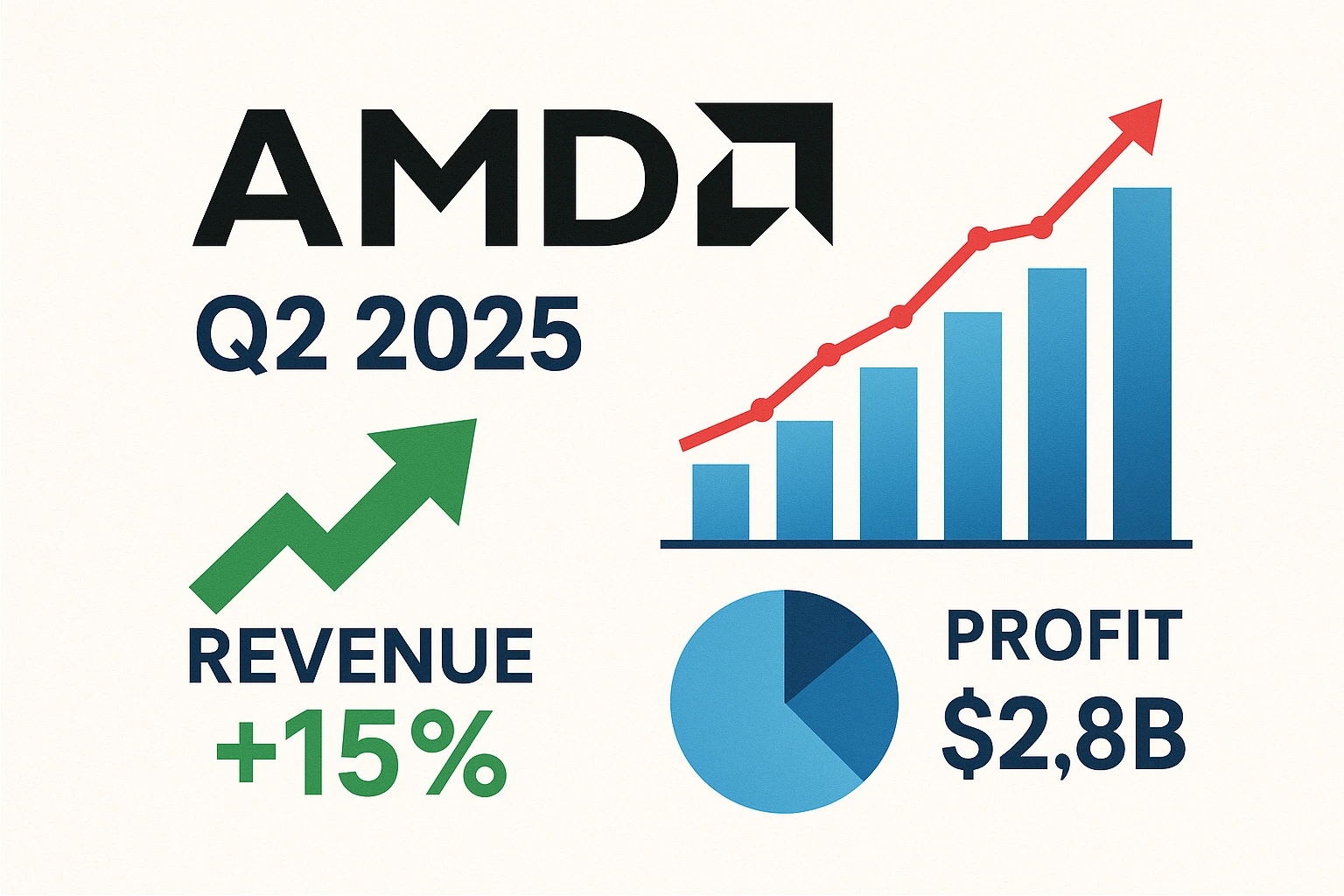

Advanced Micro Devices has delivered an impressive performance during the second quarter, showcasing remarkable resilience and growth in a challenging market environment. The company’s quarterly results have exceeded many analyst expectations, demonstrating the strength of AMD’s strategic positioning in the semiconductor industry. The earnings report reflects a comprehensive turnaround story that has captured the attention of investors and industry watchers alike.

The quarter’s financial results paint a picture of a company that has successfully navigated market headwinds while capitalizing on emerging opportunities. AMD Q2 leadership team has consistently delivered on their promises, and this quarter’s performance reinforces their commitment to sustainable growth. The quarterly results showcase not just numerical improvements, but also strategic wins that position the company for long-term success.

Breaking Down the Financial Highlights of AMD Q2 Earnings

The centerpiece of AMD Q2 success story lies in its exceptional financial results that have surpassed industry benchmarks. The company reported robust revenue growth that reflects strong demand across multiple business segments. The earnings report reveals a significant improvement in operational efficiency, with the company demonstrating its ability to scale operations while maintaining healthy profit margin levels.

One of the most striking aspects of the quarterly results is the consistent improvement in key performance indicators. The company’s profit margin expansion demonstrates effective cost management strategies while simultaneously investing in future growth opportunities. These financial results highlight AMD’s disciplined approach to balancing growth investments with profitability requirements.

The earnings report also showcases the company’s ability to generate strong cash flows, providing the financial flexibility needed for continued innovation and market expansion. This solid financial foundation has contributed to positive investor sentiment and reinforced confidence in AMD’s long-term strategic direction.

Factors Driving AMD’s Q2 Performance

Several key factors have contributed to AMD Q2 outstanding performance, with semiconductor growth playing a central role in the company’s success. The increasing chip demand across various industries has created favorable market conditions that AMD has been well-positioned to capitalize on. The company’s product portfolio alignment with market needs has been a critical success factor.

PC sales trends have shown resilience despite broader economic uncertainties, providing a stable foundation for AMD’s consumer-focused business segments. The recovery in PC sales has been particularly beneficial for AMD’s processor and graphics card divisions, contributing significantly to overall revenue growth.

The data center market has emerged as another crucial growth driver, with AMD’s server processors gaining substantial market traction. The expanding data center infrastructure requirements have created substantial opportunities for AMD’s enterprise-focused product lines, resulting in meaningful revenue contributions.

A Closer Look at Segment Performance and Revenue Distribution

AMD’s diversified business model has proven effective in delivering balanced growth across multiple segments. The computing and graphics division has shown remarkable strength, driven by robust demand for both consumer and professional graphics solutions. This segment’s performance has been bolstered by strong PC sales and increased adoption of AMD’s latest processor architectures.

The enterprise and embedded segment has demonstrated exceptional growth momentum, particularly in data center applications. This division’s performance reflects AMD’s successful penetration into high-value market segments that offer superior profit margin opportunities. The data center focus has been particularly rewarding, with enterprise customers increasingly recognizing AMD’s competitive advantages.

The company’s revenue estimates for future quarters reflect confidence in sustained performance across all major business segments. This balanced approach to revenue estimates demonstrates management’s realistic assessment of market conditions while maintaining optimistic growth projections.

The Impact of Global Market Trends on AMD’s Earnings

Global market dynamics have played a significant role in shaping AMD Q2 performance, with semiconductor growth trends providing a favorable backdrop for the company’s operations. The worldwide chip demand surge has created opportunities across multiple end markets, from consumer electronics to enterprise infrastructure.

Market reaction to AMD’s quarterly performance has been notably positive, reflecting investor confidence in the company’s strategic direction. The strong market reaction demonstrates that AMD’s execution capabilities are well-regarded by the investment community, contributing to improved stock performance metrics.

The broader technology sector’s evolution has created new revenue streams for AMD, particularly in emerging areas like artificial intelligence and machine learning. These market trends have supported semiconductor growth and positioned AMD to benefit from long-term technological shifts.

Future Outlook: What to Expect from AMD Post-Q2 Results?

Looking ahead, AMD’s guidance update provides valuable insights into management’s expectations for upcoming quarters. The guidance update reflects a balanced approach that considers both market opportunities and potential challenges, demonstrating prudent financial planning and realistic growth projections.

Analyst expectations for AMD’s future performance remain generally positive, with many industry observers highlighting the company’s strong competitive positioning. These analyst expectations are based on AMD’s proven execution capabilities and strategic market positioning across key growth segments.

The company’s stock performance outlook appears favorable, with multiple factors supporting continued investor interest. Strong stock performance potential is underpinned by solid operational fundamentals and strategic positioning in high-growth market segments.

Stock volatility considerations remain important for investors, as semiconductor companies typically experience fluctuations based on market cycles and industry dynamics. However, AMD’s diversified business model helps mitigate some stock volatility risks while maintaining growth potential.

Conclusion: Key Takeaways from AMD Q2 Earnings for Investors and Stakeholders

AMD Q2 earnings report represents a significant milestone in the company’s transformation journey, showcasing the effectiveness of strategic initiatives and operational excellence. The quarterly results demonstrate that AMD has successfully established itself as a formidable competitor in multiple high-value market segments.

The company’s improved profit margin profile and strong financial results provide a solid foundation for future growth initiatives. These achievements have positively influenced investor sentiment and positioned AMD as an attractive investment opportunity in the semiconductor sector.

For stakeholders, AMD Q2 performance validates the company’s strategic vision and execution capabilities. The earnings report confirms that AMD is well-positioned to capitalize on long-term industry trends while delivering consistent value to shareholders and customers alike.

Frequently Asked Questions (FAQ)

Q1: What were AMD’s key financial achievements in Q2?

AMD delivered exceptional financial results during Q2, with significant revenue growth and improved profitability metrics. The company exceeded analyst expectations across multiple performance indicators, demonstrating strong operational execution and market positioning.

Q2: How did AMD’s stock perform following the Q2 earnings announcement?

The stock performance following AMD Q2 results was notably positive, with strong market reaction from investors. The company’s solid earnings report contributed to improved investor sentiment and reduced stock volatility concerns in the short term.

Q3: Which business segments drove AMD Q2 growth?

AMD’s growth was primarily driven by strong performance in data center operations and resilient PC sales across consumer markets. The semiconductor growth in enterprise applications and continued chip demand in various sectors contributed significantly to overall revenue expansion.

Q4: What factors contributed to AMD’s improved profit margins in Q2?

The enhanced profit margin performance resulted from operational efficiency improvements, favorable product mix, and strong demand conditions. AMD’s focus on higher-value market segments and effective cost management strategies supported profit margin expansion throughout the quarter.