Table of Contents

The electric vehicle revolution has created unprecedented opportunities for investors, but few companies have captured attention quite like QS Corporation. This innovative battery technology company has made several strategic moves that have left the investment community buzzing with excitement and anticipation.

Introduction & Company Overview

What is QuantumScape Corporation?

QuantumScape Corporation stands as one of the most promising automotive tech disruptors in the energy storage sector. Founded with the ambitious goal of revolutionizing how we power electric vehicles, the company has positioned itself at the forefront of next-gen energy storage solutions.

The company specializes in developing solid-state batteries that promise to overcome the limitations of conventional lithium-ion technology. Unlike traditional battery manufacturers, the battery startup focuses exclusively on creating what many consider a lithium battery alternative that could reshape the entire industry.

Mission and Vision Statement

The EV battery innovator mission centers on enabling the widespread adoption of electric vehicles through breakthrough battery technology. The company envisions a future where long-range EV batteries become the standard, making electric transportation accessible and practical for consumers worldwide.

Their vision extends beyond just improving battery performance – they aim to accelerate the transition to renewable energy tech by providing the energy storage solutions needed to support a sustainable future.

1.QuantumScape Stock Performance

Current Stock Price (QS Ticker)

QuantumScape stock has experienced significant fluctuations since its public debut, reflecting both the excitement around battery technology innovation and the inherent market volatility associated with emerging technologies. The QS ticker has become a favorite among investors seeking exposure to the EV battery breakthrough sector.

Live Stock Chart and Trading Data

The company’s stock performance has been characterized by dramatic swings, often triggered by technological milestones, partnership announcements, and broader electric vehicle growth trends. These movements have created both opportunities and challenges for investors monitoring the stock.

52-Week High/Low Analysis

QuantumScape’s 52-week trading range reflects the complex investor sentiment surrounding the company. The stock has experienced both euphoric highs driven by breakthrough announcements and challenging lows during periods of market uncertainty.

Market participants have closely watched these price movements, as they often correlate with developments in the broader clean energy stocks sector and updates on the company’s technological progress.

2.Revolutionary Solid-State Battery Technology

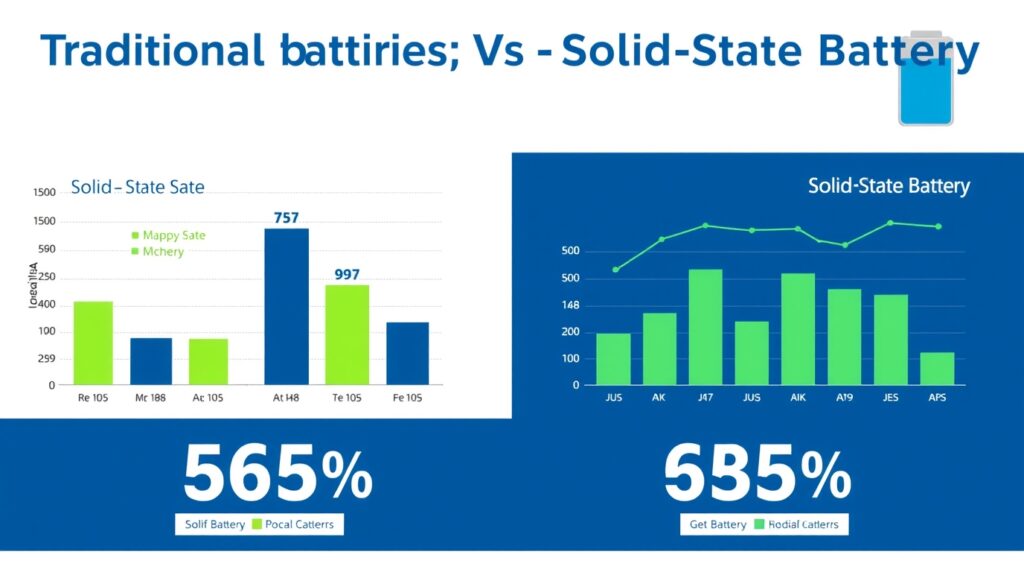

Advantages Over Traditional Lithium-Ion Batteries

QuantumScape’s solid-state batteries represent a significant battery performance leap compared to conventional lithium-ion technology. These innovative power cells offer several compelling advantages that have attracted attention from major automotive manufacturers.

The technology promises faster charging times, increased energy density, and improved safety characteristics. Unlike traditional batteries that use liquid electrolytes, solid-state batteries utilize solid electrolytes, which eliminate many of the safety concerns associated with conventional battery designs.

This advancement in high-performance batteries technology could enable vehicles to achieve greater range while reducing charging times dramatically. The implications for the future of EVs are profound, as these improvements address two of the primary concerns consumers have about electric vehicles.

3.Financial Analysis & Metrics

Revenue and Earnings Reports

QuantumScape’s financial performance reflects its status as a development-stage company focused on bringing revolutionary technology to market. The company has invested heavily in research and development, prioritizing technological advancement over immediate revenue generation.

Quarterly Financial Performance

The company’s quarterly results typically focus on key developmental milestones rather than traditional revenue metrics. Investors closely monitor progress indicators, patent filings, and partnership developments as measures of the company’s advancement toward commercialization.

4.Market Position & Competitive Landscape

QuantumScape operates in an increasingly competitive landscape where established players and emerging startups vie for position in the growing battery market. The company has differentiated itself through its focus on solid-state technology and strategic partnerships with major automotive manufacturers.

As a Tesla battery rival, QuantumScape brings unique technological advantages that could potentially challenge established players in the EV battery space. The company’s approach to solving fundamental battery limitations has garnered attention from industry experts and investors alike.

5.Investment Thesis & Risk Assessment

The investment case for QuantumScape centers on the company’s potential to revolutionize energy storage technology. Proponents argue that successful commercialization of solid-state batteries could capture significant market share in the rapidly growing EV battery market.

However, investors must also consider the inherent risks associated with developing cutting-edge technology. The path from laboratory breakthrough to mass production involves numerous challenges that could impact the company’s timeline and financial performance.

6.Partnership & Commercial Strategy

QuantumScape has pursued strategic partnerships with major automotive manufacturers to accelerate the development and commercialization of its battery technology. These alliances provide both financial support and valuable market insights that help guide product development.

The company’s commercial strategy focuses on licensing its technology to automotive partners while maintaining control over key intellectual property. This approach allows QuantumScape to benefit from the scale and manufacturing expertise of established automotive companies.

7.How to Invest in QuantumScape

Investors interested in gaining exposure to QuantumScape can purchase shares through traditional brokerage accounts using the QS ticker symbol. The stock trades on major exchanges, making it accessible to both retail and institutional investors.

Those considering green tech investment should carefully evaluate their risk tolerance and investment timeline before making any decisions. The company’s development-stage status means that returns may be volatile and uncertain.

FAQ Section

Is QuantumScape a good investment?

The investment potential of QuantumScape depends largely on the company’s ability to successfully commercialize its solid-state battery technology. While the technology shows promise, investors should carefully consider the risks associated with early-stage technology companies.

When will QuantumScape be profitable?

QuantumScape’s path to profitability depends on successfully bringing its technology to market and achieving commercial scale. The company has provided guidance on development timelines, but investors should understand that technology development often involves unexpected challenges and delays.

What makes their technology different?

QuantumScape’s solid-state battery technology offers several advantages over traditional lithium-ion batteries, including improved safety, faster charging, and higher energy density. These improvements could address key limitations that have hindered broader EV adoption.

How does QuantumScape compare to Tesla?

While Tesla focuses on vehicle manufacturing and has developed its own battery technology, QuantumScape specializes exclusively in advanced battery development. The companies serve different roles in the EV ecosystem, with QuantumScape potentially supplying technology to multiple automotive manufacturers.

What are the biggest risks?

The primary risks include technology development challenges, manufacturing scale-up difficulties, competition from established players, and the inherent uncertainties associated with emerging technologies. Additionally, broader market conditions and regulatory changes could impact the company’s prospects.