Introduction: Why Store-Branded Credit Cards Are Worth Considering

Store-branded credit cards, also known as store brand credit cards, are financial tools offered by retailers that provide exclusive perks to their customers. Unlike traditional credit cards, these cards are specifically tied to a particular store or retail chain, allowing users to enjoy rewards, discounts, and financing options. For frequent shoppers, a store brand credit card can be a great way to save money and access special promotions. However, to truly maximize the benefits, it is essential to understand how they work, their advantages, and the potential drawbacks. This guide will help you make the most out of your store brand credit experience.

How Store-Branded Credit Cards Work

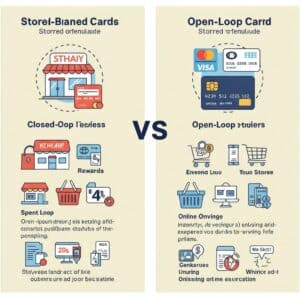

A store brand credit card operates similarly to a regular credit card but is primarily used for purchases within a specific store or group of stores. There are two main types:

Closed-Loop Store Credit Cards – These can only be used at the issuing retailer’s stores.

Open-Loop Store Credit Cards – These are co-branded with major payment networks like Visa or Mastercard and can be used anywhere those networks are accepted.

Retailers partner with financial institutions to issue these cards, allowing them to offer special incentives like cashback, discounts, or 0% interest financing on large purchases. However, they often come with high-interest rates, so it’s important to manage them wisely to avoid unnecessary debt.

Key Benefits of Store-Branded Credit Cards

A store brand credit card comes with multiple advantages that can enhance your shopping experience:

1. Exclusive Discounts and Promotions

Many retailers provide immediate discounts on purchases when using their store brand credit. For instance, a department store may offer 15% off your first purchase when you sign up for their card.

2. Rewards Programs and Cashback

Most store cards have a rewards program where users earn points for every dollar spent. These points can be redeemed for future purchases, helping you save more money in the long run.

3. Special Financing Offers

Many store brand credit cards offer interest-free financing for large purchases. This is particularly useful for buying big-ticket items like furniture or electronics without paying upfront.

4. Early Access to Sales and Exclusive Events

Retailers often give cardholders early access to sales, product launches, and VIP shopping events. This perk is great for those who love getting the best deals before the general public.

5. Building Credit History

If you’re new to credit or looking to improve your credit score, a store brand credit card can help. By making timely payments and keeping your balance low, you can boost your credit score over time.

Great for store card recommendations NerdWallet’s Best Store Credit Cards

How to Maximize Rewards and Savings

To get the most out of your store brand credit, follow these strategies:

1. Choose the Right Store Card

Pick a store brand credit card from a retailer where you frequently shop. This ensures that you maximize rewards and discounts.

2. Use It Alongside Other Promotions

Combine store card benefits with coupons, seasonal discounts, and cashback offers to maximize savings.

3. Pay the Balance in Full Every Month

Most store brand credit cards have high APRs. Avoid interest charges by paying off your balance in full each month.

4. Leverage Introductory Offers

Take advantage of signup bonuses and 0% financing options wisely. Use these offers for planned purchases rather than impulse buys.

5. Redeem Rewards Strategically

Instead of using rewards points immediately, wait for major sales events to get even better value from your points.

Potential Downsides to Watch Out For

While store brand credit cards have attractive benefits, they also come with some drawbacks:

1. High Interest Rates

Many store cards come with APRs above 25%, making them expensive if you carry a balance.

2. Limited Usability

Closed-loop store cards can only be used at the issuing retailer, which limits their flexibility compared to traditional credit cards.

3. Low Credit Limits

These cards often have lower credit limits, which can negatively impact your credit utilization ratio if not managed carefully.

4. Temptation to Overspend

The promise of rewards and discounts can encourage unnecessary spending, leading to debt accumulation.

Best Practices for Using Store-Branded Credit Cards

To use a store brand credit card effectively, follow these best practices:

Track Your Spending: Keep an eye on your purchases to avoid overspending.

Monitor Your Credit Score: Regularly check your credit report to ensure your store card is helping, not hurting, your credit.

Set Up Auto-Payments: Avoid late fees by setting up automatic payments for your card balance.

Know the Terms and Conditions: Understand fees, interest rates, and expiration dates on rewards to prevent surprises.

Top Store-Branded Credit Cards in the USA

Here are some of the best store brand credit cards available in the U.S.:

Amazon Prime Rewards Visa Signature Card – Offers 5% cashback on Amazon and Whole Foods purchases.

Target RedCard – Provides 5% off on all Target purchases and free shipping for online orders.

Best Buy Credit Card – Offers special financing and rewards on electronics purchases.

Walmart Capital One Rewards Card – 5% cashback on Walmart.com and 2% cashback in stores.

Home Depot Consumer Credit Card – Features special financing options on home improvement projects.

For a more detailed comparison, check out this guide on the best store credit cards.

Conclusion: Are Store-Branded Credit Cards Right for You?

A store brand credit card can be a valuable financial tool if used wisely. If you frequently shop at a specific retailer and can pay your balance in full each month, these cards can help you save money and enjoy exclusive perks. However, if you tend to carry a balance, the high interest rates may outweigh the benefits.

Before applying for a store brand credit, assess your spending habits, compare different cards, and ensure you can manage the financial responsibility. When used strategically, store cards can provide significant savings and enhance your shopping experience.

Would you like help in selecting the best store credit card based on your shopping habits? Let us know in the comments below!