Table of Contents

Introduction

China Investments Behind the scenes of diplomatic tensions and border disputes lies an extraordinary economic story that few people fully understand. A hidden $12 billion transformation is quietly revolutionizing India’s electronics sector, reshaping everything from smartphone manufacturing to semiconductor assembly. This massive wave of Chinese FDI in India represents one of the most significant technology partnerships in recent history, fundamentally changing how Indians access and interact with electronic devices.

The transformation extends far beyond simple manufacturing setups. It involves sophisticated strategic technology partnerships that bring cutting-edge production capabilities to Indian soil, create hundreds of thousands of jobs, and position India as a global electronics hub. While headlines focus on geopolitical complexities, the real story unfolds in factories across Karnataka, Tamil Nadu, and Uttar Pradesh, where billions of dollars in investments are creating a new technological landscape.

This revolution challenges conventional wisdom about India-China trade relations. Despite periodic tensions, business relationships continue to flourish through carefully structured agreements that comply with foreign direct investment rules while delivering substantial benefits to both nations. The $12 billion figure represents more than capital flows; it symbolizes a fundamental shift in how global technology companies view India’s manufacturing potential.

Understanding this transformation requires looking beyond surface-level headlines to examine the intricate web of investments, partnerships, and policy frameworks that make this revolution possible. The story reveals how strategic economic cooperation can thrive even amid complex diplomatic relationships, creating value for consumers, businesses, and entire economies.

1.The $12 Billion Secret Unveiled

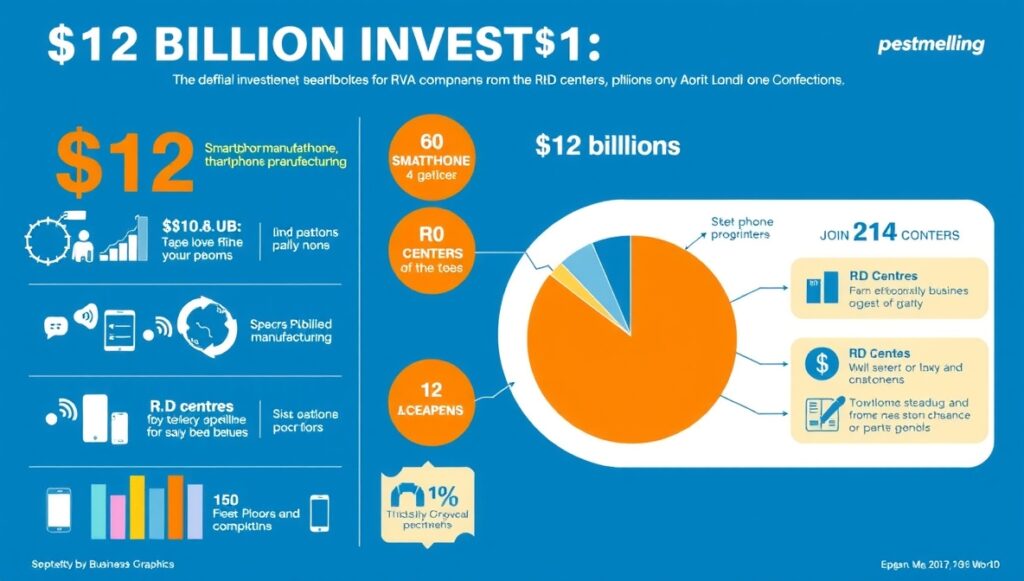

Breakdown of the $12B Investment Figure Across Major Sectors

China Investments $12 billion landscape reveals a carefully orchestrated electronics sector investment strategy spanning multiple interconnected sectors. Smartphone manufacturing commands the largest portion, accounting for approximately $7.2 billion of total commitments. This substantial allocation reflects the massive scale of production facilities, advanced machinery procurement, and comprehensive supply chain development required to serve India’s enormous mobile phone market.

Component manufacturing represents the second-largest investment category, with $2.8 billion dedicated to establishing sophisticated production capabilities for batteries, displays, chargers, and various smartphone components. These investments demonstrate how Chinese electronics companies in India are building integrated manufacturing ecosystems rather than simple assembly operations.

Research and development facilities constitute a significant $1.2 billion investment segment, focusing on software customization, hardware adaptation, and innovation centers that cater specifically to Indian market preferences. These facilities employ thousands of local engineers and developers, creating high-skilled employment opportunities while advancing India’s technological capabilities.

The remaining $800 million spreads across infrastructure development, logistics networks, retail expansion, and training programs. This comprehensive approach ensures that investments create sustainable, long-term value while complying with Indian government FDI norms and contributing meaningfully to local economic development.

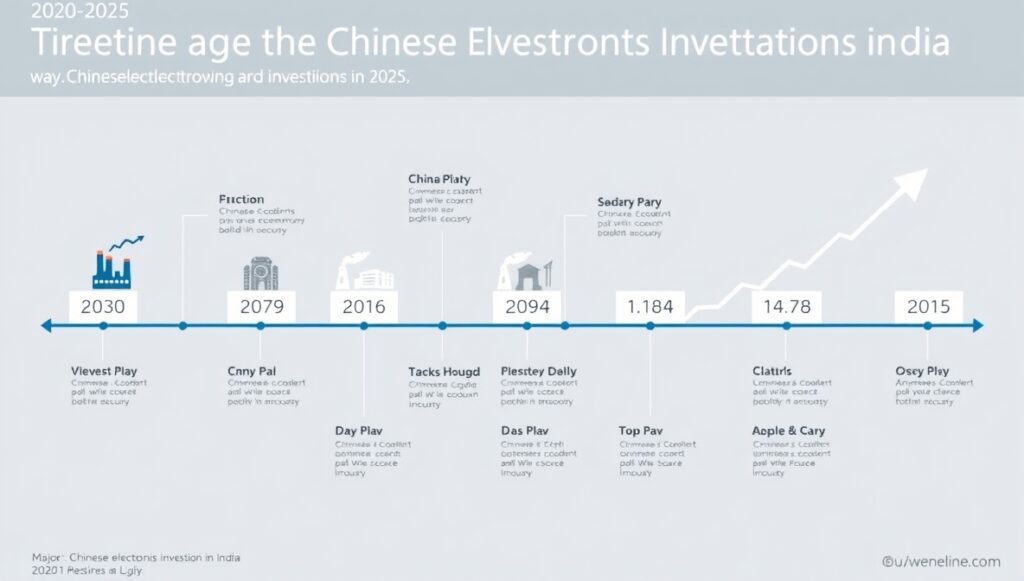

Timeline of China’s Electronics Investment Surge (2020-2025)

The China Investments surge began gaining momentum in 2020, when global supply chain disruptions created new opportunities for localized manufacturing. China to India tech investment accelerated as companies recognized India’s potential as both a massive consumer market and a strategic production base for serving global markets.

2021 marked a pivotal year with multiple major announcements totaling over $4 billion in committed investments. The India FDI policy reforms during this period provided clearer guidelines and streamlined approval processes, encouraging more structured partnerships between Chinese and Indian companies. Several leading smartphone manufacturers announced significant expansion plans during this transformative year.

By 2022, the focus evolved toward building comprehensive electronics manufacturing in India capabilities that could serve both domestic demand and export markets. This year witnessed the establishment of multiple component manufacturing facilities, with particular emphasis on battery production technologies and display assembly capabilities.

2023 brought enhanced regulatory scrutiny through improved foreign investment screening mechanisms, but also provided greater clarity in approval procedures. The FDI approval from DPIIT process became more efficient for investments demonstrating clear technology transfer benefits and substantial job creation potential.

2024 represents a maturation phase, with existing investments expanding operations and new partnerships focusing on advanced technologies like artificial intelligence, 5G infrastructure, and sustainable manufacturing processes. Cross-border technology deals during this period emphasized innovation and environmental sustainability.

Looking toward 2025, industry projections suggest continued growth in FDI in electronics industry segments, particularly in areas that align with India’s infrastructure development goals and digital transformation initiatives.

Key Chinese Companies Leading the Charge

Several major Chinese technology companies have emerged as primary drivers of this $12 billion China Investments revolution. Xiaomi leads the smartphone manufacturing segment with over $2 billion in committed investments across multiple Indian states. The company has established sophisticated production facilities that manufacture devices not only for the Indian market but also for export to neighboring countries.

Oppo and Vivo collectively represent another $2.5 billion in manufacturing and retail China investments. These companies have built extensive manufacturing capabilities while developing comprehensive retail networks that serve both urban and rural markets across India. Their investments include advanced component sourcing agreements and tech transfer agreement structures that bring valuable manufacturing expertise to Indian partners.

Foxconn, while being a Taiwanese company, serves as a crucial manufacturing partner for many Chinese brands, contributing approximately $3 billion toward establishing mega-factories in India. These facilities represent some of the most advanced electronics manufacturing capabilities in the region.

OnePlus has focused on premium market segments with targeted investments of around $800 million, emphasizing quality manufacturing and brand building initiatives that have successfully captured significant market share in India’s high-end smartphone segment.

Government Policies Enabling This Investment Wave

The Indian government has implemented several policy frameworks that facilitate responsible Chinese FDI in India while maintaining appropriate oversight mechanisms. The updated India FDI policy provides clear guidelines for technology sector China investments, creating predictable regulatory environments that encourage long-term commitments.

Bilateral tech agreements between India and China have established frameworks for technology transfer, intellectual property protection, and dispute resolution mechanisms. These agreements create confidence for investors while ensuring that investments contribute meaningfully to India’s technological advancement.

The Make in India electronics initiative has provided specific incentives for companies willing to establish manufacturing facilities, transfer technology, and create substantial employment opportunities. These policies align foreign investments with national development priorities.

Foreign direct investment rules have been refined to balance openness with security considerations. The government has created clear categories for different types of China Investments, with streamlined approval processes for investments that meet specific criteria related to technology transfer and job creation.

2.Major Chinese Electronics Investments in India

A. Smartphone Manufacturing Hub

India has emerged as a global smartphone manufacturing powerhouse, largely driven by massive Chinese investments in production capabilities. The transformation began with companies establishing assembly operations and gradually evolved into comprehensive manufacturing ecosystems that produce components locally.

Major smartphone manufacturers have invested in state-of-the-art production facilities across multiple Indian states. These facilities employ advanced automation technologies while creating substantial employment opportunities for local workers. The manufacturing operations extend beyond simple assembly to include sophisticated processes like printed circuit board assembly, battery integration, and quality testing.

The smartphone manufacturing hub concept involves creating integrated supply chains where multiple companies collaborate to produce different components within the same geographic region. This approach reduces logistics costs, improves quality control, and creates economies of scale that benefit all participants.

Strategic technology partnerships within the smartphone sector have enabled knowledge transfer between Chinese companies and Indian suppliers. Local companies have gained access to advanced manufacturing techniques, quality control processes, and supply chain management expertise that enhance their capabilities significantly.

B. Component & Semiconductor Push

The component manufacturing sector represents one of the most technologically sophisticated aspects of China investments in India. Companies have established facilities for producing batteries, display panels, chargers, and various electronic components that serve both domestic and export markets.

Battery manufacturing has received particular attention, with multiple companies investing in lithium-ion battery production capabilities. These facilities utilize advanced technologies that ensure high energy density, safety, and environmental compliance. China investments include comprehensive recycling programs that address end-of-life battery management.

Display technology investments focus on producing high-quality screens for smartphones, tablets, and other consumer electronics. These facilities employ sophisticated manufacturing processes that require significant technology transfer and skills development programs for local workers.

Semiconductor assembly operations, while not involving chip fabrication, focus on packaging and testing processes that add substantial value to imported semiconductor components. These operations require precise manufacturing capabilities and represent important steps toward building India’s semiconductor ecosystem.

C. Infrastructure & Technology Centers

Research and development centers established by Chinese companies serve as innovation hubs that adapt global technologies for Indian market requirements. These centers employ thousands of local engineers, software developers, and designers who work on customizing products and developing new solutions.

The technology centers focus on software development, user interface design, and hardware optimization that addresses specific Indian market preferences and usage patterns. This localization process ensures that products meet local requirements while maintaining global quality standards.

Training and skills development programs associated with these centers have created valuable human capital that benefits the entire Indian electronics ecosystem. Engineers and technicians trained in these programs often move to other companies, spreading knowledge and expertise throughout the industry.

Infrastructure China investments include logistics networks, testing facilities, and quality assurance laboratories that support the entire electronics manufacturing ecosystem. These facilities ensure that products meet international quality standards while reducing time-to-market for new products.

3.The Revolution’s Impact on India

A. Economic Transformation

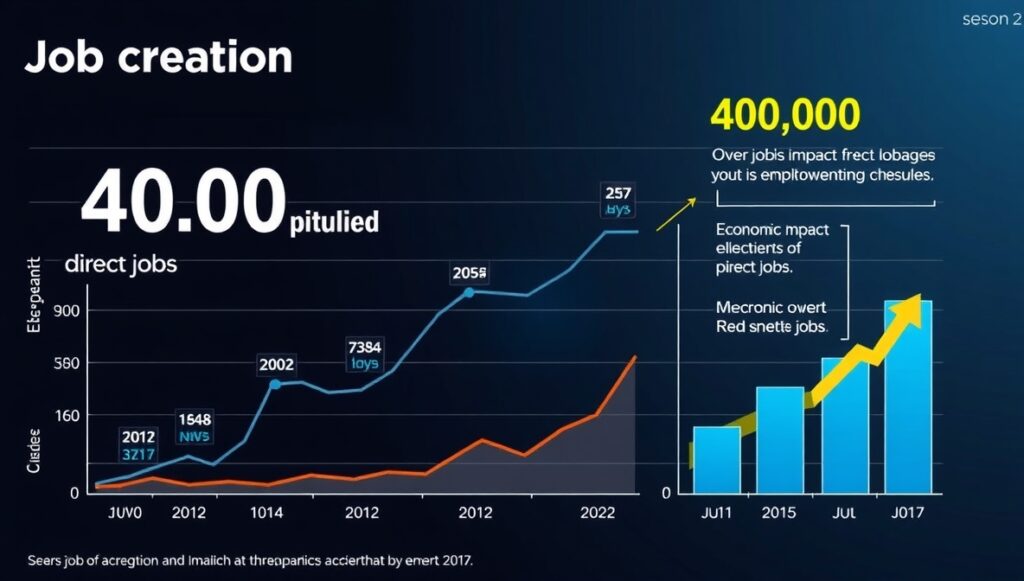

The $12 billion China Investment wave has created a profound economic transformation that extends far beyond the electronics sector. Direct employment generation exceeds 400,000 jobs across manufacturing, research and development, retail, and support services. These positions range from entry-level assembly work to highly skilled engineering and management roles.

Indirect employment effects multiply the economic impact significantly. Local suppliers, logistics companies, packaging manufacturers, and service providers have all benefited from increased business volumes. Economic studies suggest that each direct job in electronics manufacturing creates approximately 2.5 additional jobs in supporting industries.

Export potential has expanded dramatically as India-based manufacturing facilities serve regional and global markets. The country has become a significant exporter of smartphones and components to markets across Asia, Africa, and other regions. This export capability has improved India’s trade balance and foreign exchange earnings.

Tax revenue generation from these investments contributes substantially to both central and state government budgets. Corporate taxes, goods and services taxes, and various fees associated with these operations provide funding for public infrastructure and social programs.

The India FDI tech transfer condition requirements have ensured that investments contribute to local technological capabilities rather than simply establishing production facilities. This approach has created sustainable competitive advantages that will benefit India’s economy for decades.

B. Technology Advancement

Technology transfer represents one of the most valuable aspects of China investments in India. Local companies and workers have gained access to advanced manufacturing techniques, quality control processes, and supply chain management expertise that significantly enhance their capabilities.

Skills development programs associated with these investments have created a substantial pool of trained workers who understand modern electronics manufacturing processes. These skills are transferable and benefit the entire Indian manufacturing sector as workers move between companies and industries.

Innovation ecosystem development has accelerated through the establishment of research and development centers that collaborate with local universities and research institutions. These partnerships have created new opportunities for applied research and technology commercialization.

Digital infrastructure improvements associated with these investments include advanced communication networks, data management systems, and automated manufacturing processes that serve as models for other industries seeking to modernize their operations.

4.Strategic Implications & Concerns

India’s Dependency Risks and Supply Chain Vulnerabilities

While the $12 billion China Investment wave has created substantial benefits, it has also raised important questions about dependency risks and supply chain vulnerabilities. India’s electronics ecosystem has become significantly integrated with Chinese suppliers, creating potential vulnerabilities during periods of diplomatic tension.

Supply chain concentration represents a particular concern, as many critical components continue to be imported from China despite local manufacturing expansion. This concentration could create disruptions if trade relationships face significant challenges or if global supply chains experience major disruptions.

Technology dependency concerns focus on the extent to which Indian companies rely on Chinese partners for critical technical expertise and intellectual property. While strategic technology partnerships have facilitated knowledge transfer, questions remain about India’s ability to maintain and advance these capabilities independently.

National security China Investment rules have been implemented to address some of these concerns, but balancing security considerations with economic benefits remains an ongoing challenge. The government continues to refine policies that promote beneficial investments while maintaining appropriate safeguards.

Restricted FDI sectors guidelines help ensure that investments in sensitive areas receive appropriate scrutiny, but the rapid pace of technological change makes it challenging to anticipate all potential security implications of new technologies and business models.

5.Future Outlook & Predictions

Projected China Investments Trends for 2025-2030

Industry analysts project continued growth in electronics China investments in India, with an estimated additional $8-10 billion expected during the 2025-2030 period. These future investments are likely to focus on advanced technologies, sustainable manufacturing processes, and emerging product categories.

Artificial intelligence and machine learning applications represent significant growth areas for future cross-border technology deals. Companies are expected to establish specialized facilities for developing AI-powered consumer electronics and industrial applications tailored for Indian markets.

5G technology infrastructure represents another major investment opportunity as India expands its telecommunications networks. Chinese electronics companies in India are well-positioned to participate in this expansion through equipment manufacturing and technology services.

Sustainable manufacturing technologies are expected to receive increased attention as both companies and consumers prioritize environmental responsibility. Future investments will likely emphasize renewable energy, recycling technologies, and sustainable materials sourcing.

Electronics manufacturing in India capabilities are projected to expand into new product categories including electric vehicle components, renewable energy systems, and industrial automation equipment. These expansions will require additional technology transfers and skills development programs.

6.What This Means for Consumers & Businesses

Impact on Electronics Pricing and Availability

The massive scale of Chinese investments in India has created substantial benefits for consumers through improved product availability and competitive pricing. Local manufacturing has reduced import duties and logistics costs, making smartphones and other electronics more affordable for Indian consumers.

Product customization has improved significantly as manufacturers develop devices specifically tailored for Indian market preferences. This localization includes language support, cultural adaptations, and feature sets that address local usage patterns and requirements.

Service and support capabilities have expanded dramatically with local manufacturing presence. Consumers benefit from improved warranty services, faster repair capabilities, and more responsive customer support as companies establish comprehensive service networks.

New Product Categories Entering Indian Market

FDI in electronics industry has facilitated the introduction of numerous product categories that were previously unavailable or prohibitively expensive in the Indian market. These include advanced wearable devices, smart home products, and specialized electronics for various professional applications.

Innovation acceleration has resulted from local research and development capabilities that can respond more quickly to market demands and emerging trends. This responsiveness has led to faster product launches and more frequent feature updates that benefit consumers.

Market competition has intensified as multiple Chinese companies establish significant operations in India. This competition drives innovation, improves quality, and maintains competitive pricing that benefits all consumers regardless of their preferred brands.

Conclusion

Eectronics $12 billion China investments revolution in India represents a remarkable example of how economic cooperation can create substantial value despite complex geopolitical relationships. This transformation has fundamentally changed India’s electronics landscape, creating hundreds of thousands of jobs, establishing advanced manufacturing capabilities, and positioning the country as a significant player in global electronics markets.

The success of this China investments wave demonstrates the importance of clear regulatory frameworks, foreign investment screening processes, and policies that balance openness with appropriate safeguards. India’s approach to managing Chinese FDI in India provides valuable lessons for other countries seeking to benefit from foreign investment while maintaining sovereignty and security.

Looking forward, the foundation established through these investments creates opportunities for continued growth and development. The skills, infrastructure, and relationships built during this period will continue to generate benefits for decades to come, contributing to India’s emergence as a major technology hub.

The story of China’s $12 billion electronics, China investments in India ultimately illustrates how strategic economic partnerships can transcend political complexities to create mutual benefits. While challenges and concerns remain, the substantial positive impacts on employment, technology advancement, and consumer welfare demonstrate the potential for continued cooperation in the technology sector.

FAQ

Q: How much has China invested in India’s electronics sector?

A: Chinese companies have invested approximately $12 billion in India’s electronics sector between 2020-2025, spanning smartphone manufacturing, component production, and technology centers.

Q: Which Chinese companies are leading investments in India?

A: Major investors include Xiaomi, Oppo, Vivo, OnePlus, and manufacturing partners like Foxconn, with combined commitments exceeding $12 billion across various electronics segments.

Q: How many jobs have China investments created?

A: Direct employment exceeds 400,000 jobs, with indirect employment effects creating approximately 1 million additional jobs in supporting industries and services.

Q: What types of products are manufactured in India through these investments?

A: Primary products include smartphones, batteries, display panels, chargers, and various electronic components, with expanding capabilities in emerging technologies.

Q: How do these investments comply with Indian regulations?

A: China Investments follow India FDI policy guidelines, undergo foreign investment screening, and meet India FDI tech transfer condition requirements to ensure technology transfer and local benefit creation.